Embarking on the journey of retirement often prompts a series of important decisions. One of the biggest – and most exciting – decisions you will make is where to spend your retirement. If you’ve thought about senior living and have been doing research, then you know there are many options. Finding the ideal senior living arrangement is a significant step, and the landscape is rich with choices. But which one is right for you? As you research, you’ll discover continuing care retirement communities (CCRCs), sometimes called life plan communities.

To help you evaluate your choices, you’ll need to understand what continuing care retirement communities provide along with an idea of their costs and contract obligations.

Statement of Fairness: Considering senior living options for yourself or a loved one? We’re here to help at every step. And even though we specialize in independent living communities, our goal is for YOU to find your best path to gracious retirement living, and part of how we achieve that is by providing reliable information on all types of senior living, not just the ones we offer. When our offerings serve as useful illustrations to a specific topic, you can find that information in the attached sidebar.

What is a Continuing Care Retirement Community?

CCRCs are designed with a comprehensive approach, aiming to provide residents with a continuum of care that evolves to meet their changing needs. The allure lies in the promise of a supportive environment where individuals can age gracefully without the need to relocate as their health needs shift. A CCRC provides living arrangements that ranges from standalone homes, townhouses and apartments to private or semi-private rooms.

With almost 2,000 CCRCs across the country, these communities provide independent living, assisted living and skilled nursing care, all within one community.

Continuing care retirement communities are ideal for:

- Individuals looking for a comprehensive long-term living situation with a variety of options now and in the future

- Couples whose spouse or partner requires a different level of care

Understanding CCRCs

As in other retirement communities, CCRCs are maintenance-free and offer:

- Choice of housing based on availability

- Meal plans

- Recreational and social activities

- 24-hour security

- Transportation

- Housekeeping

- Building modifications to promote accessibility and mobility

- Emergency help

What Is a Continuum of Care?

A continuing care retirement community has a continuum of care. This simply means that a CCRC can provide different levels of senior care services based on community availability as well as each resident’s physical needs and abilities.

What Are the Different Levels of Care?

Independent Senior Living

This maintenance-free lifestyle comes with a variety of housing options: standalone homes, townhouses, condos and apartments. Community dining, services and recreational activities are geared to the interests of older adults. Independent senior living is ideal for individuals who require little to no assistance with daily living tasks.

Assisted Living

Assisted living services encourage independence but offer a higher level of support. Older adults in assisted living receive all the services provided in independent living plus:

- Help with the activities of daily living (dressing, bathing, walking, toileting)

- Medication reminders

- Personalized care plans

Memory Care

This level of senior care refers to a specialized type of long-term care that is designed to meet the unique needs of individuals with Alzheimer’s disease, dementia and other memory-related disorders. Memory care programs are specifically tailored to provide a safe and supportive environment for individuals experiencing memory loss.

Skilled Nursing

Skilled nursing care is the highest level of care in a CCRC and is designed for individuals who require 24-hour medical care and assistance with all activities of daily living. Residents in skilled nursing care typically have their own rooms and receive care from a team of health care professionals, including nurses, therapists and social workers. Skilled nursing staff can administer:

- Physical therapy

- Occupational therapy

- Speech therapy

- IV therapy

- Post-stroke, after-surgery and cardiac care

What Are The Benefits of a Continuing Care Retirement Community?

CCRCs offer a range of benefits that can make them an appealing option for older adults who are looking for a secure and supportive place to retire. While CCRCs offer the same benefits as other senior living arrangements, they do offer their own unique advantages, including:

- Levels of care. CCRCs provide a continuum of care, ensuring that residents have access to the appropriate level of support as their needs evolve. This can be a significant source of peace of mind for both residents and their loved ones, knowing that care is readily available if needed.

- Access to health care services. CCRCs typically have health care services available on-site, including assisted living and skilled nursing care. This means that residents can receive necessary medical care without needing to leave the community. This can be a major convenience, especially for older adults who may have difficulty managing multiple care arrangements.

- Aging in place. Residents can age in place within the same community, promoting a sense of familiarity and continuity. This is especially beneficial for couples or individuals who want to stay together even if one partner requires a higher level of care.

- Predictable expenses. CCRCs typically require an entrance fee and monthly fees, which cover the cost of future care. This can provide peace of mind for residents knowing that their long-term care expenses are covered.

How Much Do CCRCs Cost?

A continuing care retirement community costs more than other senior living choices. You’ll be charged an entry fee and monthly expenses based on services. These prices vary depending on the geographic location and your lifestyle.

Understanding the Financial Structure of CCRCs

The entrance fee, also known as buy-in fee, will secure your place in the community. Your buy-in fee pays for your ability to move from one care level to another. This amount also goes into maintaining and improving the buildings. Across the country, the buy-in fee can range anywhere from $40,000 up to $2 million. The national average is $414,722.

Monthly expenses cover amenities and services (meals, maintenance, housekeeping, activities and events, plus personal assistance as needed).

How Much Should I Budget for Monthly Fees?

In 2021, the average totalled $3,555 per month. However, these costs have been rising by 4% or more per year.

How Can I Finance the Entrance and Monthly Fees?

Many people use the profits from selling their home to finance the entrance fee. While waiting for those funds, short-term home equity loans and bridge financing are available. In some continuing care retirement communities, the entrance fee can be partially refunded based on how long the resident lives there.

Once you’ve secured housing in a CCRC, there are also ongoing monthly fees to consider. These ongoing expenses can be covered by a variety of sources.

Retirement income from Social Security, pensions and retirement savings can be a steady source of income for these costs. Long-term care insurance can also play a role. Many policies offer daily or monthly benefits to help cover assisted living or nursing care expenses within the CCRC.

Health savings accounts (HSAs) offer another financing option. Funds accumulated in HSAs can be used for qualified medical expenses, including some long-term care costs. Medicare and Medicaid can also be potential resources. While Medicare generally doesn’t cover long-term care, Medicaid may offer assistance, depending on your income and assets. It’s important to explore eligibility requirements carefully.

Remember: The best financing option for you will depend on your individual financial situation, risk tolerance and long-term care needs. Consulting with a financial advisor can help you create a personalized plan for managing both entrance fees and ongoing monthly costs in a CCRC.

Understanding a CCRC Contract

As you visit continuing care retirement communities, you’ll notice some differences. One of these is the type of contract you’ll need to sign.

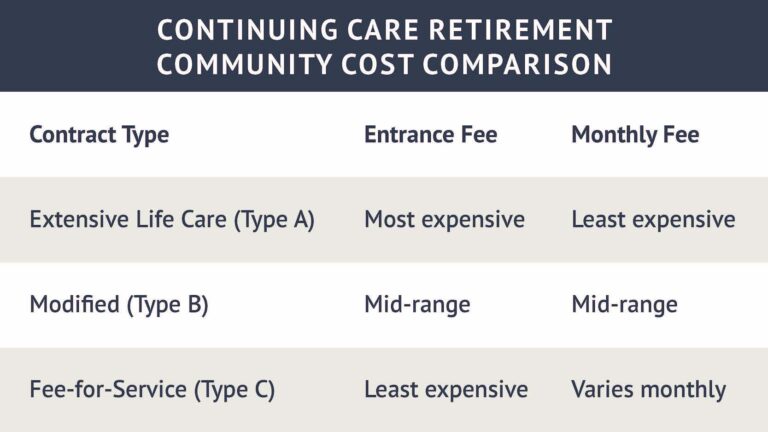

Buy-in contracts come in three forms and determine the amount you’ll pay as an entrance fee.

- Extensive life-care contract (Type A). Assisted living, along with medical and nursing care will be provided at no extra cost to you. You are prepaying for health care services that you may, or may not, need in the future.

- Modified contracts (Type B). You’ll receive medical services for a limited time and up to a certain dollar amount. If you need more care in the future, your costs will rise.

- Fee-for-service contracts (Type C). This is a pay-as-you-go model, and while this is the least expensive entrance amount, the monthly fees can add up.

Like any legal document, contracts are complicated. If you choose a CCRC, read your contract thoroughly or ask the advice of a legal professional. Make sure you are fully confident in your decision and understand the contract before signing.

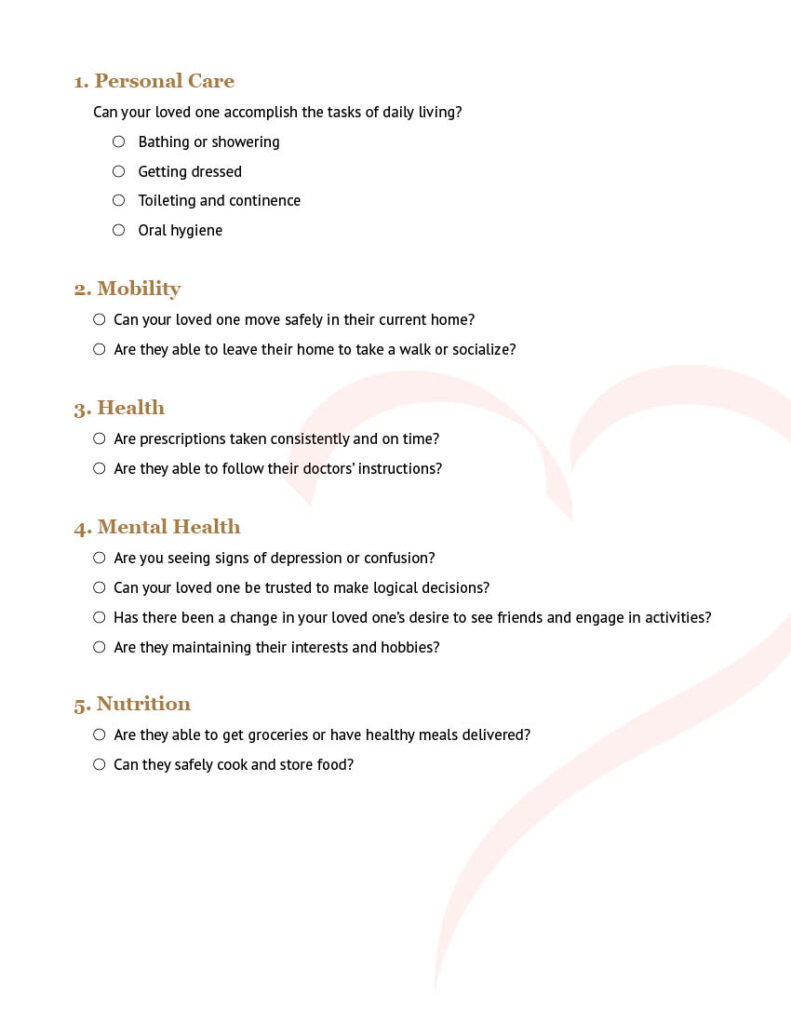

Three Factors to Consider Before Choosing a CCRC

- Financial. CCRCs can be a significant financial investment. Carefully consider your budget and whether you can afford the entrance fee and monthly fees. Consider consulting a financial advisor for personalized guidance.

- Health Needs. Assess your current health status and anticipate any potential future care requirements. If you foresee needing assisted living or skilled nursing care, a CCRC can provide a seamless transition and peace of mind. However, if you prefer to manage your own care arrangements, a CCRC may not be right for you and other senior living options may offer a more tailored fit.

- Personal Preferences. Assess your desired level of independence, social engagement and amenities. CCRCs offer a range of activities and services, but it’s essential to ensure the community aligns with your interests and personality. Think about your preferred living environment, the type of activities you enjoy and the overall atmosphere you seek.

- Do you get a good feeling from the community after a tour?

- Is the location close enough for your friends and family?

- Is the environment enriching? Do you see a lot of activity?

- Did you get a warm welcome from staff and residents?

Unsure if a Continuing Care Retirement Community (CCRC) is the Right Choice?

Thinking ahead about your retirement living situation is a smart decision that can greatly benefit your future. While CCRCs offer a continuum of care and peace of mind for many seniors, it’s essential to explore all your senior living options before making a decision.

Choosing a CCRC is a significant commitment, both financially and emotionally. It may not fit every budget or lifestyle preference. Fortunately, CCRCs aren’t the only option available. Independent living communities provide an attractive alternative, offering an enriching lifestyle with amenities, services and activities for adults. Unlike CCRCs, independent living communities don’t require residents to have additional support or care on-site, providing freedom and flexibility while still fostering a sense of community.

Our blog post dives deeper into the comparison between independent living and CCRCs, offering clarity and guidance as you begin your senior living journey. Explore how these options align with your needs, preferences, and budget considerations to make an informed decision that sets the stage for a fulfilling retirement lifestyle.

Make an Informed Decision

Every question you ask and all the research you do is important. Understanding your senior living options takes you one step closer to a happier, more fulfilling life. A CCRC is just one type of retirement community among many others. By knowing what’s important to you and the financial impact of your decision, you can relax and get the most out of your retirement years.

DID YOU ENJOY WHAT YOU JUST READ?

Join our exclusive community and subscribe now for the latest news delivered straight to your inbox. By clicking Subscribe, you confirm that you agree to our terms and conditions.

Make Your Retirement

Years Hassle-Free

Experience the freedom of senior independent living in Bethlehem, Pennsylvania. That’s free as in worry-free, maintenance-free and free to choose how you’ll spend your day. Your all-inclusive monthly rate covers dining and snacks, activities and events, utilities, basic cable, transportation, and a resident travel program.

Discover Luxury Retiremen Lliving at Wilshire Estates

You’ll find our independent senior living residence in the charming city of Silver Spring, Maryland. Around every corner, you’ll discover an active community involved in group classes, crafts, gardening, outings and wellness programs. Besides all that, your monthly rent covers delicious meals, snacks, transportation, utilities and so much more. Your pets are welcome, too!

See what we’re doing this month in our newsletter.

UP NEXT

13 min read

How to Cut Costs for Retirement

How do you know if you’re saving enough for retirement? It’s a question we ask ourselves often. We all want our golden years to be stress-free, but the financial planning part can be confusing. If you’ve ever wondered how to ensure your retirement nest egg not only lasts but thrives, you’re in the right place. This isn’t about pinching pennies; it’s about finding ways to make your money go further.

Frequently Asked Questions:

What is a continuing care retirement community (CCRC), and what does it offer?

A continuing care retirement community (CCRC), also known as a life plan community, provides a full continuum of care – including independent living, assisted living and skilled nursing care – all within one community. This allows residents to age in place and transition seamlessly between levels of care as their needs change, without having to move to a new location.

What are the main financial considerations when choosing a CCRC?

CCRCs typically require an entrance fee (which can range from tens of thousands to over a million dollars) and ongoing monthly fees that cover amenities, services and varying levels of care. The cost structure depends on the type of contract. Some contracts guarantee future care at no extra cost, while others require additional fees as care needs increase. It’s important to review contract terms carefully and consult a financial advisor to ensure the arrangement fits your budget and needs.

What factors should I consider when evaluating if a CCRC is right for me?

When evaluating a CCRC, consider your current and anticipated future health needs, your financial situation (including the ability to afford entrance and monthly fees), and your personal preferences for community life, activities, and amenities. Also, assess the community’s atmosphere, the friendliness of staff and residents, and the location’s convenience for family and friends. Touring the community and reviewing contract details can help you make an informed decision.

FIND YOUR COMMUNITY

Related Articles

STORIES, INSIGHTS & RESOURCES

As you and your loved ones navigate the exciting opportunities retirement presents, thoughtful planning is key. Stay informed with empowering articles for seniors covering health, lifestyle, finance and more.

Chronicles Of The Heart

RESIDENTS SAY INDEPENDENCE IS A TOP PRIORITY

Below, residents explain how much they appreciate the freedom they experience at our independent living community. It’s empowering to continue to make your own decisions, and you’re free to create your day around your personal interests.