More results...

As we all move through our later years, it is crucial to have a solid understanding of the financial considerations surrounding your preferred senior living options. No matter your preferred type of housing or support, this resource guide aims to provide you with valuable insights and practical strategies to help you navigate the complexities of planning and managing your finances during this important phase of life.

Embracing and learning about key concepts like housing costs, expense planning, health management, financial peace of mind and investing in yourself as part of a fulfilling retirement lifestyle, you can be confident in your readiness to make informed decisions that support your independence and preserve your financial stability.

Here are the main sections you can explore in this resource guide.

Reminder: You can access the table of contents on the left to move around different sections easily.

In this section, we will explore the various models of retirement living, including independent senior living, assisted living, memory care, nursing homes and continuing care retirement communities (CCRCs). Learn to compare the average monthly and annual costs, as well as deposit expenses. This overview will help you determine suitable retirement living options based on your needs and budget.

For those who are assuming financial responsibility for the first time or after a long while, this section is dedicated to helping you become comfortable and educated about managing your finances. We will explain important financial concepts, offer practical advice on money management, and review the importance of seeking assistance from professionals such as financial advisors, estate planning attorneys, and accountants.

Effective financial planning is essential for a smooth comfortable retirement. This section will guide you through the process of organizing your living expenses. It begins with a personal financial assessment to make sure you have clarity on your current financial status. Then learn about tools to aid in budgeting for housing and retirement communities. Finally, get guidance and resources on creating a budget that can support your goals.

Healthcare expenses can significantly impact your retirement budget, and are a common source of worry among older adults. In this section, we will delve into Medicare coverage and costs, Medicare supplement insurance, and Medicare Advantage plans. Discover new insights on budgeting for deductibles, copays, co-insurance, and other healthcare expenses. Additionally, you can learn strategies to save on healthcare costs through smart shopping, preventative care services, and wellness programs.

This section provides you with a range of tips and strategies to save money on senior living expenses. Learn about everything from researching and comparing senior living options to shopping around for the best deals, negotiating with senior living communities, and exploring discounts and subsidies. You’ll also get equipped with the tools to effectively manage your expenses while maximizing your savings.

Finally, learn the importance of investing in a retirement lifestyle that prioritizes quality of life. It’s easy to get caught up in the minutiae of financial planning and miss the most important part of senior living: Living Well! By evaluating what’s most important to you and your ongoing quality of life, you can invest your finances in the opportunities and resources that provide you with the retirement you deserve. Follow a step-by-step process to help you identify your retirement lifestyle goals, aspirations, and requirements.

Let’s Dive In!

Choosing the right retirement living option is a significant decision that impacts both your quality of life and financial well-being. So understanding the various types of senior living models, along with their associated costs, is crucial for making an informed and confident choice.

In this section, you will explore the most popular senior living options, including independent senior living, assisted living, memory care, nursing homes, and continuing care retirement communities (CCRCs). Then compare the average monthly and annual costs as well as deposit costs for each option. This information is largely based on nationwide analyses, so it’s important to account for differences in your local area, accommodation size, services provided, and quality of life features.

Independent senior living communities cater to active and self-sufficient older adults who desire a maintenance-free lifestyle in a vibrant and supportive community setting. Residents typically live in apartments, cottages, or villas and have access to amenities such as restaurant-style dining, fitness centers, social activities, and transportation assistance. Monthly costs can vary based on location, size of accommodation, and amenities offered.

| Location | Average Monthly Cost | Deposit Cost |

|---|---|---|

| A | $2,500 – $4,500 | $1,000 – $5,000 |

| B | $2,000 – $3,500 | $1,500 – $7,500 |

| C | $3,000 – $5,000 | $2,000 – $10,000 |

Assisted living communities provide personalized care and skilled support for activities of daily living (ADLs) while promoting independence. Residents typically have their own apartments or private rooms and receive support with medication management, housekeeping, meal preparation, and transportation. The costs of assisted living depend on factors such as location, level of care needed, and size of accommodation.

| Location | Average Monthly Cost | Deposit Cost |

|---|---|---|

| A | $3,500 – $5,500 | $2,000 – $10,000 |

| B | $4,000 – $6,000 | $3,000 – $15,000 |

| C | $3,000 – $5,000 | $2,500 – $12,000 |

Memory care communities specialize in providing a secure and supportive environment for individuals with Alzheimer’s disease, dementia, or other memory-related conditions. These communities offer 24/7 supervision, structured activities, and specialized care. Costs can vary based on location, level of care needed, and amenities provided. Many communities contain Memory care accommodations in addition to their other senior living options, but dedicated Memory care communities are also available.

| Location | Average Monthly Cost | Deposit Cost |

|---|---|---|

| A | $4,500 – $6,500 | $2,000 – $12,000 |

| B | $5,000 – $7,500 | $3,000 – $15,000 |

| C | $4,000 – $6,000 | $3,500 – $18,000 |

Nursing homes, also known as skilled nursing facilities, provide comprehensive care for individuals with complex medical needs or disabilities. These facilities have trained health care professionals who offer 24/7 medical supervision, assistance with daily activities, and rehabilitation services. Costs depend on factors such as location, level of care required, and room type.

| Location | Average Monthly Cost | Deposit Cost |

|---|---|---|

| A | $6,000 – $8,500 | $3,000 – $20,000 |

| B | $7,000 – $9,500 | $4,000 – $25,000 |

| C | $5,000 – $7,000 | $4,500 – $30,000 |

CCRCs offer escalating levels of care, ranging from independent living to assisted living and nursing care, all within one community. Residents can transition to higher levels of care as their needs change. CCRCs usually require substantial entrance fees, along with monthly fees that vary based on the level of care and amenities included.

| Location | Entrance Fee Range | Monthly Fee Range |

|---|---|---|

| A | $100,000 – $500,0000 | $3,000 – $6,000 |

| B | $150,000 – $600,000 | $3,500 – $7,500 |

| C | $200,000 – $700,000 | $4,000 – $8,000 |

Note: The range of costs provided in the tables represents average estimates of specific metro areas. We do this in the hope that these are representative of normal experiences. However, costs may vary significantly based on the specific community, location, and individual needs.

All in all, understanding the costs associated with different senior living options is essential to getting the greatest bang for your buck. When researching senior housing options for yourself or a loved one, consider factors such as location, apartment size, services provided, and living conditions, then evaluate your budget and preferences to find the most suitable retirement living option.

Taking control of your home finances can be a daunting task, especially if you haven’t overseen them before or if it’s been a long time. Fortunately, numbers are still numbers and with the right knowledge and guidance, managing your finances can become a source of empowerment, confidence, and peace of mind. This section focuses on practical advice and important financial concepts to help older adults become comfortable and educated about their finances.

A Point of Clarity: We are proud of our work and legacy of providing senior housing to older adults for decades. But we are NOT financial advisors. The information here is based on our experiences with the common financial challenges facing older adults and should not be confused for financial advice. Always seek professional advice when you need help with your financial plan.

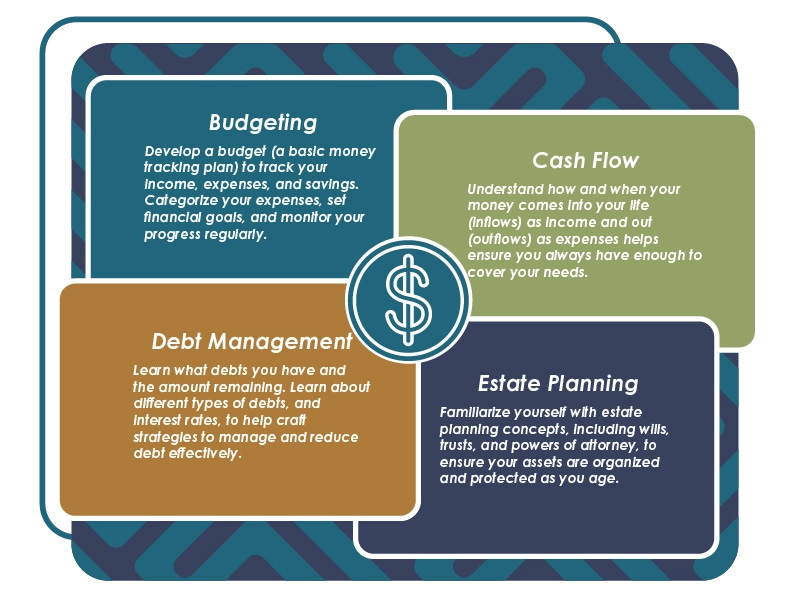

Getting comfortable with your finances means grasping a few key financial concepts.

Budgeting: Develop a budget (a basic money tracking plan) to track your income, expenses, and savings. Categorize your expenses, set financial goals, and monitor your progress regularly.

Cash Flow: Understanding how and when your money comes into your life (inflows) as income and out (outflows) as expenses helps ensure you always have enough to cover your needs.

Debt Management: Learn what debts you have and the amount remaining. Learn about different types of debts and interest rates to help craft strategies to manage and reduce debt effectively.

Estate Planning: Familiarize yourself with estate planning concepts, including wills, trusts, and powers of attorney, to ensure your assets are organized and protected as you age.

It’s easy for the complexity of financial management to get overwhelming in the same way that caring for a large house can be overwhelming. Simply, the more there is, the more needs done to maintain and preserve it. Engaging financial professionals can provide valuable guidance and expertise. Think about how the following service providers might make managing your finances simpler and less stressful:

Financial Advisors: You may choose to work with a certified financial advisor who specializes in retirement planning. They can help assess your financial goals, create an investment strategy, and offer personalized advice on how to manage your assets to achieve your goals.

Estate Planning Attorneys: Consult an estate planning attorney to ensure your legal documents are in order, such as wills, trusts, and advance healthcare directives. Many of these structures are designed to benefit retirees seeking to get the most from their nest egg.

Accountants or Tax Professionals: Seek assistance from an accountant or tax professional to navigate tax-related matters, optimize deductions, and ensure compliance with tax laws. Accountants and bookkeepers can review and optimize your budget to help you make sure your spending stays in alignment with your goals.

Investing wisely can help grow your wealth and provide financial security in retirement. The following basic investing principles can help you understand your current investing strategy, but investing also comes with serious risks. Definitely speak to your professional financial advisor when evaluating investments.

Diversification: Diversification means to spread out the dollars in your investment portfolio by allocating funds across different asset classes, such as stocks, bonds, real estate, and mutual funds. This strategy helps reduce risk.

Retirement Accounts: You can take advantage of retirement accounts like Individual Retirement Accounts (IRAs) and 401(k)s. These investments allow you to contribute regularly to maximize tax advantages and build savings.

Annuities: If your investments include annuities, they can provide a steady stream of income over a specified period or for life. Do some research to learn the different types, such as fixed annuities and variable annuities, and their associated benefits and risks.

Insurance can play a crucial role in protecting your financial well-being. Look through your financial documentation and see if you currently have any of the following policies:

Health Insurance: Review your health insurance coverage, including Medicare and supplemental policies. Understand deductibles, copayments, and limitations to effectively plan for medical expenses.

Long-Term Care Insurance: Evaluate the benefits of long-term care insurance to help cover the costs of care in a variety of settings, including independent living, assisted living, memory care or nursing home care. You are probably active and independent now, but long-term care coverage can protect you in case you need significant support. Make sure to assess coverage options, premiums, and eligibility criteria.

Life Insurance: Determine if maintaining or acquiring life insurance is necessary to provide financial support for your loved ones or cover any outstanding debts.

Taking charge of your home finances as an older adult may seem overwhelming at first, but with the right knowledge and assistance, you can gain confidence and peace of mind. Getting comfortable means taking time to research, ask questions, get professional advice, and digest all this information before making choices you feel good about. Again, make sure you utilize professionals when seeking financial advice. When you are comfortable, supported, and actively managing your finances, you can create a secure and stable financial foundation to support your retirement goals and dreams.

Once you have an idea of how/where you would like to live, planning for senior living costs is the next step in ensuring a comfortable and financially secure retirement. By learning how to estimate senior housing expenses and the costs of your preferred lifestyle, then implementing sound financial planning strategies, you can make informed and confident decisions while getting prepared for any future support needs. This section explores the key aspects of planning for senior living costs, including assessing your financial situation, budgeting for retirement living, maximizing income, reducing expenses, and considering long-term care insurance.

Before delving into senior living costs, it’s essential to assess your current financial situation. Consider the following factors:

Income sources: Evaluate your sources of income, such as pensions, Social Security benefits, retirement accounts, annuities, and rental income.

Assets and savings: Take stock of your savings, investments, real estate properties, and any other assets that can contribute to your retirement funding.

Debts and expenses: Analyze your existing debts, including mortgages, credit card balances, and loans. Assess your monthly expenses to determine how they may change during retirement.

Estimating senior living costs requires a careful consideration of various factors. While costs can vary significantly based on location, amenities, and care level, you can use the following methods to estimate expenses effectively:

Cost calculators and estimators: Utilize online tools and resources specifically designed to estimate senior living costs based on your preferences, location, and desired level of care.

Inflation: Account for inflation when estimating future expenses. Keep in mind that healthcare costs and long-term care expenses tend to increase at a higher rate than general inflation.

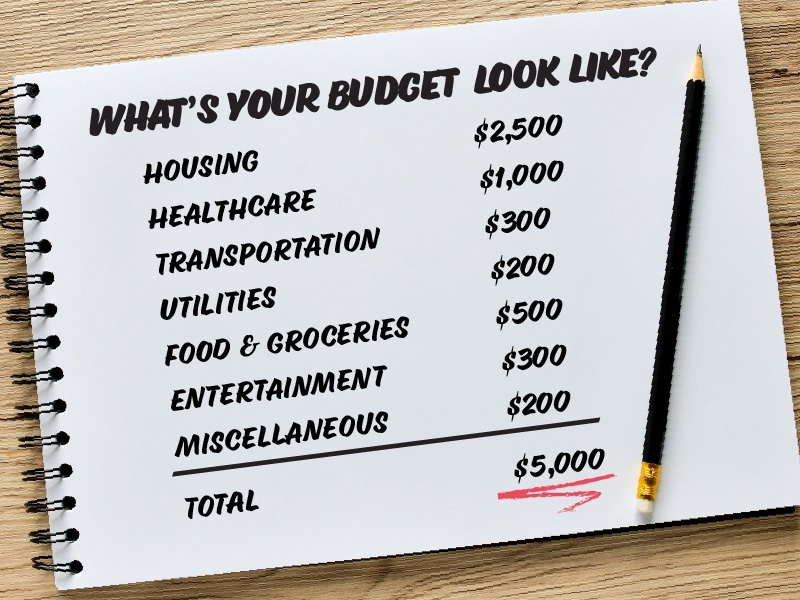

Developing a budget and financial plan is crucial for managing senior living costs. Consider the following steps:

To ensure sufficient funds for senior living costs, consider the following strategies:

| Expense Category | Monthly Allocation |

|---|---|

| Housing | $2,500 |

| Health Care | $1,000 |

| Transportation | $3,000 |

| Utilities | $200 |

| Food and Groceries | $500 |

| Entertainment | $300 |

| Miscellaneous | $200 |

| Total | $5,000 |

Note: The figures in the table are for illustrative purposes only and should be adjusted based on individual circumstances and location.

Conclusion: Planning for senior living costs requires careful consideration and financial preparedness. By assessing your financial situation, estimating costs effectively, creating a budget and financial plan, and implementing strategies to maximize income and reduce expenses, you can better manage your retirement care expenses.

As you enter this new phase of your life, managing healthcare costs becomes a crucial aspect of your personal and financial planning. This section provides insights on how to prepare for and manage healthcare expenses in retirement. We will explore important topics such as Medicare coverage and costs, Medicare supplement insurance, and Medicare Advantage plans. Delve into budgeting for deductibles, copays, coinsurance, and the potential benefits of a health savings account (HSA). Finally, learn how to find opportunities to save on healthcare costs through smart decision-making and utilization of available resources.

Medicare is a federal health insurance program for individuals aged 65 and older, as well as some younger individuals with specific disabilities. Medicare is a large program with many moving parts. If you need assistance understanding or enrolling in Medicare for your state. Check out these three sites:

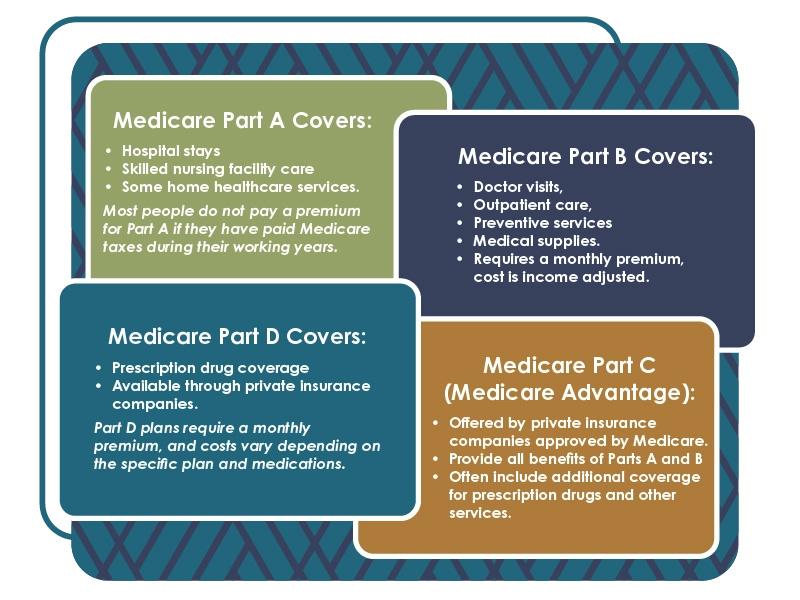

But as an overview of Medicare coverage, here’s what you need to know:

Medicare Part A: Covers hospital stays, skilled nursing facility care, and some home healthcare services. Most people do not pay a premium for Part A if they have paid Medicare taxes during their working years.

Medicare Part B: Covers doctor visits, outpatient care, preventive services, and medical supplies. Part B requires a monthly premium, and the cost is based on your income.

Medicare Part C (Medicare Advantage): These plans are offered by private insurance companies approved by Medicare. They provide all the benefits of Parts A and B, and often include additional coverage for prescription drugs and other services.

Medicare Part D: Provides prescription drug coverage and is available through private insurance companies. Part D plans require a monthly premium, and costs vary depending on the specific plan and medications.

Medicare Supplement Insurance, also known as Medigap, is a form of private medical insurance that covers out-of-pocket expenses not covered by original Medicare. With a Medicare Supplement Plan, you can go to any doctor that accepts Medicare.

Medigap Benefits: Medigap policies cover deductibles, copayments, and coinsurance, and may offer additional benefits like coverage for foreign travel emergencies.

Enrolling in Medigap: It’s crucial to enroll in a Medigap policy during your Medigap Open Enrollment Period, which starts on the first day of the month you turn 65 and are enrolled in Medicare Part B. According to Medicare.gov, “During this time, you can enroll in any Medigap policy and the insurance company can’t deny you coverage due to pre-existing health problems.”

Medigap Costs: Medigap premiums vary depending on the plan you choose, your location, age, and health status. You can get direct cost information from Medicare.gov.

A Medicare Advantage Plan (sometimes called “Part C” or “MA Plan,”) is another health plan choice you may have as part of Medicare. If you join a Medicare Advantage Plan, a private company, approved by Medicare, will provide all your Part A (hospital Insurance) and Part B (medical Insurance) coverage. Medicare Advantage Plans may offer extra coverages, such as dental, vision, hearing, and/or health and wellness programs. Most include Medicare prescription drug coverage (Part D).

Plan Variety: The main attraction for Medicare Advantage Plans are the additional benefits, such as prescription drug coverage, dental care, and vision services. You can shop around various plans to find your ideal mix.

Network Restrictions: Medicare Advantage plans often have different rules for how you get services. Common restrictions may require you to use healthcare providers within a specific network, and these rules can change each year.

Cost Consideration: Medicare Advantage plans may have lower monthly premiums than original Medicare, but they may also have copayments, deductibles, and coinsurance for services.

Once you understand your current healthcare coverage and needs, budgeting for the associated expenses becomes essential. Consider the following, and discuss your budget with your medical providers to make sure that all your care needs are accounted for.

Deductibles, Copays, and Coinsurance: Understand the out-of-pocket expenses associated with your Medicare, Medicare Advantage and Medigap plans. Put these costs into your budget and ensure you have funds set aside to cover them. You can find accurate information on original Medicare costs on their resource site.

Health Savings Accounts (HSAs): If you have a high-deductible health plan of any type, consider opening an HSA to save pre-tax dollars for medical expenses. HSAs can provide tax advantages and help you prepare for healthcare costs in retirement. Self-directed HSAs are often administered by professional financial advisors.

If you are feeling intimidated by your healthcare costs, then good news! There are several opportunities and tactics you can use to save on healthcare expenses in retirement. For example:

Prescription Savings: Compare prescription drug prices and consult with your provider about generic options. You can also save money by utilizing mail-order pharmacies and prescription discount programs to reduce costs.

Preventive Care Services: Take advantage of Medicare-covered preventive services, such as screenings, vaccines, and wellness visits. These services can help detect and prevent health issues early, potentially reducing long-term healthcare costs.

Wellness Programs and Discounts: Explore wellness programs and discounts offered by insurance providers (Including some Medicare Advantage Plans) and community organizations. These programs may offer gym memberships, exercise classes, nutrition counseling and other resources at reduced rates or for free.

Retirement Community Activities: Many retirement communities fill their calendars with activities and routines designed with whole-person wellness in mind. Finding the activities that fit your requirements and goals can enhance your health and well-being in meaningful ways for no additional cost.

Managing healthcare costs in retirement requires careful planning and informed decision-making. Understanding your Medicare coverage options, exploring Medigap and Medicare Advantage plans, budgeting for out-of-pocket expenses, and utilizing savings opportunities can help you navigate the complexities of healthcare expenses. By taking small, proactive steps and making informed choices, you can confidently manage your healthcare costs and enjoy a healthier, more financially secure retirement.

Transitioning into a senior housing community can be a significant financial decision. However, there are several strategies you can employ to save money while maintaining a high quality of life. In this section, we will explore various tactics that can help you reduce senior living costs. From researching and comparing options to leveraging government programs and benefits, these strategies will empower you to make informed financial choices.

The list below contains several different tips and tactics for saving money. Not all of them may work for your specific goals or financial limitations. Remember to review your financial decisions with financial professionals if you need assistance or support. By implementing the ideas that work for you, you can maximize your savings and make the most of your senior living experience.

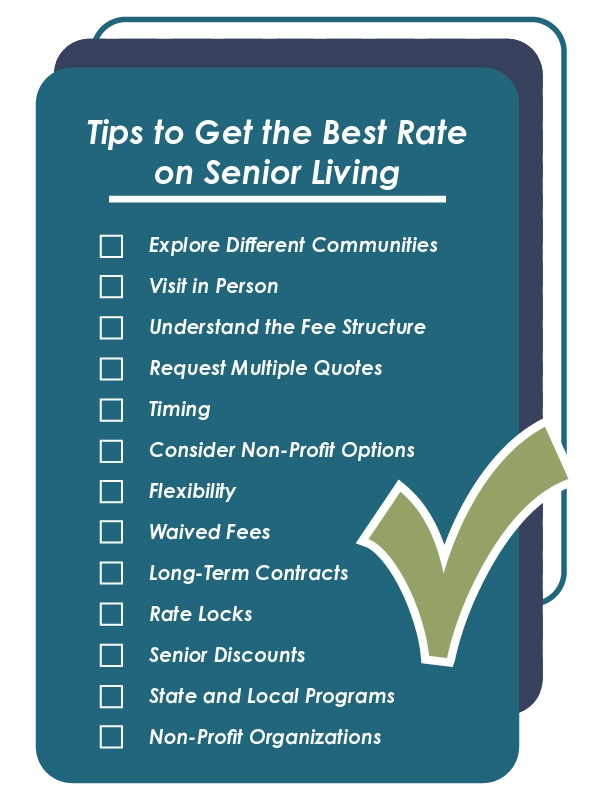

Earlier in this article we discussed the average price you can expect to pay for the most popular kinds of senior housing. Thorough research is key to finding the right senior living community for you, at an affordable price. Here are a few tips to help you get the best value:

Explore Different Communities: Research a variety of senior living communities to compare costs, amenities and services. Weigh the location, levels of care, and community reputation carefully in your decision process, and try to see how pricing changes based on these factors.

Visit in Person: Schedule tours and visits to senior living communities of interest and consider doing a tour more than once for your favorite candidates. Talk to current residents and staff members to get a sense of the atmosphere and quality of care. If family support is important for you, talk with resident families to learn what their experience with the community has felt like.

Understand the Fee Structure: Determine how costs are calculated, such as entrance fees, monthly fees, and additional charges for specific services. Understand what is included in the base fee, what might require an extra cost, and how often rent and service prices increase.

Just as you would for any other significant purchase, it’s important to shop around for the best deals when considering senior living options. Consider the following:

Request Multiple Quotes: Obtain quotes from different senior living communities to compare pricing structures and negotiate better rates.

Timing: Be aware that prices may vary depending on the time of year or current availability. If you have flexibility on your move dates, consider waiting until the off-peak season to negotiate a lower rate.

Consider Non-Profit Options: Non-profit senior living communities may offer more affordable pricing structures due to their mission-driven nature.

Negotiation can be an effective strategy to secure better rates and financial arrangements. The following negotiation tactics reflect our experience managing senior housing, and the kind of incentives and deals we see being offered in the industry. Like most negotiations, all the tactics below require you to reach an agreement with the individual community you are interested in and are not guaranteed to be accepted.

Flexibility: Discuss flexible payment options, such as monthly payments or a phased move-in, to make the financial burden more manageable, especially when you have substantial fee or deposit schedules such as a CCRC.

Waived Fees: Inquire about the possibility of having certain fees waived, such as entrance fees or community fees.

Long-Term Contracts: Negotiate discounts or reduced rates for long-term commitments or extended stays. Note: Choosing to sign a long-term lease may save you money, but terminating such an agreement early could involve penalties. Always consult with your financial and legal professionals before signing any agreement.

Rate Locks: As market rate pricing becomes the norm for retirement communities around the country, annual rent increases are becoming increasingly common. One money-saving tactic can be negotiating a rate lock on your rent and community fees for multiple years.

There may be various discounts and subsidies available to help lower senior living costs. These may include federal, state and community-level resources. So grab a notepad and let’s start googling.

Senior Discounts: Inquire about senior discounts for housing, transportation, and other services in your chosen senior living community or local area. Not all communities accept all discount programs, so be sure to ask about each resource individually.

State and Local Programs: Research state and local programs that provide financial assistance or subsidies for senior living. You can find a directory of state housing programs at HUD.gov.

Non-Profit Organizations: Explore grants or scholarships provided by non-profit organizations that aim to support seniors in accessing affordable senior living options. These options can often take some work to find, but are often known to non-profits working in your local eldercare space.

By making educated choices regarding housing and lifestyle, and getting support for any changes you choose, you can save significantly on senior living costs. Here are just a few of the lifestyle choices that can positively impact your wallet.

Downsizing and Decluttering: Moving to a smaller living space can reduce monthly expenses. When moving from your current home, consider selling or donating possessions to simplify the transition, earn extra income, and create new space for things you collect while making new memories.

Roommate Options: Explore the possibility of sharing living spaces with a roommate to split the cost of housing, utilities, and other expenses. In some communities you will pay a fee for the second person on your lease, but the extra expense is more than offset by splitting the whole rent.

Meal Plans: Evaluate meal plans provided by the senior living community. While all of our own communities offer full dining for no additional charge, many other senior living communities have tiered meal plans or à la carte dining options. Determine if opting out or selecting a less expensive meal plan would be a more cost-effective option for your lifestyle.

Government programs and benefits are a common source of financial assistance for seniors. Note that many of the federal programs that cover senior housing expenses can be used only at select communities. Check with your community of interest to see if your assistance program is accepted.

Medicaid: (as opposed to Medicare) is a joint federal and state program that covers medical expenses for low-income individuals and people with certain disabilities. In some states, Medicaid may also cover certain long-term care services, if you meet certain qualifying criteria.

Medicare: Make sure you understand your Medicare coverage and how it can help with healthcare expenses. Consider supplemental Medicare policies and wellness initiatives that can fill gaps in coverage, and save you money by keeping you in peak health for longer.

Social Security and Retirement Benefits: Maximize your Social Security benefits by understanding the best time to start receiving them. Explore other retirement benefits, such as pensions or 401(k) plans, to supplement your income.

Veterans Benefits and Programs: If you are a veteran or the spouse of a veteran, explore the benefits and programs available through the Department of Veterans Affairs (VA) that can help with senior living costs.

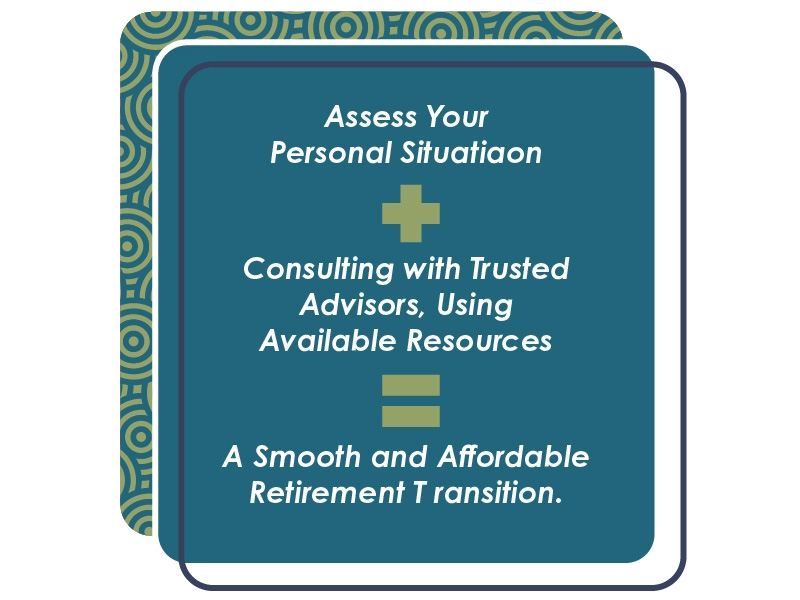

As you can see, there are numerous ways to save money on senior living costs. By implementing strategies that align with your goals, you can effectively save money on senior living costs while making informed and confident financial decisions. Remember to assess your personal situation, consult with professionals when needed, and take advantage of available resources to ensure a smooth transition into an affordable and comfortable retirement lifestyle.

When looking over all the costs associated with retirement living, it’s easy to get bogged down by the numbers, spreadsheets, tables, checklists, statements, and applications. Finance is serious stuff, but it’s not everything. When you look over the whole of your finances and what you want to accomplish, it’s essential to prioritize a life of joy, of vibrant relationships and new opportunities alongside financial responsibility and budget management. So let’s shift our focus to capturing and prioritizing quality of life, regardless of the community you choose to reside in.

Investing in a retirement lifestyle that meets your needs and desires can greatly enhance your overall well-being and happiness. It’s time to let go of the notion that investing in yourself is a luxury or selfishness. Regardless of the type of community you opt for, prioritizing a life filled with excitement and fulfillment is crucial.

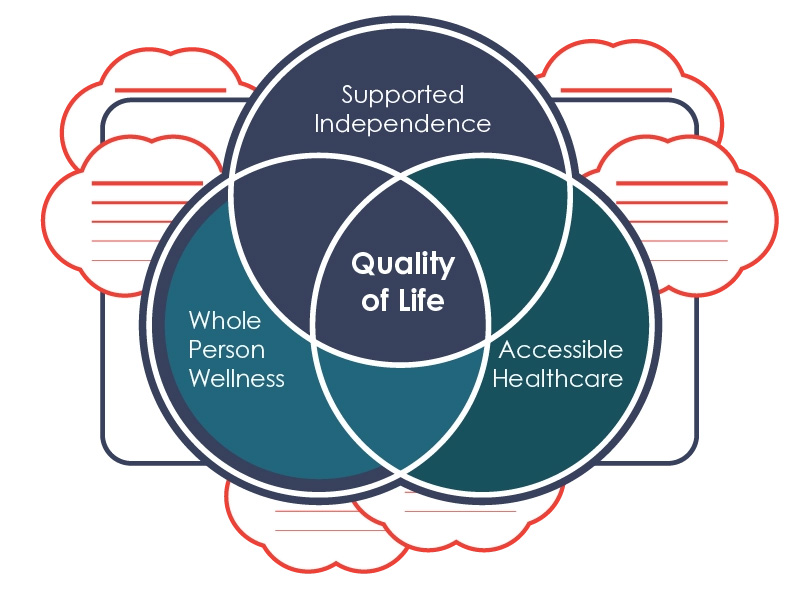

Retirement communities, regardless of their level of care, can offer a range of amenities and services that greatly enhance your experience. Consider how you could use the following elements that contribute to a high quality of life:

Personalized Assistant: Some communities may have concierge services to help with various tasks, like scheduling appointments, making reservations and coordinating transportation, ensuring convenience and peace of mind. These services are also available from individuals for an hourly rate, or smart technologies like Alexa and Google for even less.

Well-being Programs: Engage in comprehensive wellness programs tailored to your specific needs, including fitness classes, nutrition counseling, and health screenings, promoting a healthy and active lifestyle. As mentioned previously, a wellness lifestyle often has associated financial benefits.

Accessible Healthcare: Many communities provide on-site healthcare services, ensuring easy access to medical professionals and specialized care when required. Check with your community to see what providers are available or close by who could work for your needs.

Maintaining social connections and staying engaged in meaningful activities is vital for a fulfilling life, regardless of the retirement lifestyle you choose. Consider the following opportunities for social interaction:

Community Events and Activities: Participate in a variety of organized events, such as social gatherings, hobby clubs, educational workshops, and cultural outings, fostering connections with like-minded individuals. Get out into your community and discover where your people are.

Welcoming Community Spaces: Especially when touring senior living communities, look for thoughtfully designed common areas that encourage interaction and provide opportunities to connect with fellow residents. Ask current residents how the space is used, and make sure the community spaces in your community foster a sense of belonging.

Tailored Social Programs: Explore community-specific programs that promote social engagement, such as group outings, volunteer initiatives, and intergenerational activities, creating opportunities for meaningful connections. Allowing yourself to have fun and novel experiences is vital to developing new and healthy friendships.

Comfort and convenience are essential for enhancing your daily living experience. Your definition and preferred level of comfort may vary wildly from your peers and that’s perfectly good. Comfort and convenience are all about making your retirement great for you as an individual.

Thoughtfully Designed Personal Spaces: We all have a standard of living that speaks to us. Get inside your own head and think through what makes a space “Homey” for you? Do you need separate areas for leisure and entertaining guests? Would you rather not deal with guests? You may want to pursue apartments slightly larger or smaller than your initial expectation.

Hassle-Free Living: It’s time to relish the freedom of not-your-problem! You’ve spent your life working to support and provide for others, maybe it’s your turn for some pampering. Take time to acknowledge and enjoy the time you get back by not having to cook, clean, fix the house, and take everybody everywhere. Be present in the good life, you earned it.

Convenient Transportation: You probably want to keep driving and that’s good. But don’t undervalue the convenience of having convenient and professional transport. Community transport service can facilitate shopping, appointments, and outings, providing the independence you desire without the stress of driving, gas, or car maintenance, ensuring ease and flexibility.

Part of investing in quality of life is getting clarity on your retirement lifestyle goals and aspirations.

Personal Preferences: Reflect on the activities, hobbies, and interests that really bring you joy and consider how living in a retirement community aligns with those preferences. Look for solutions and community amenities that help ensure a fulfilling and engaging lifestyle.

Health and Well-being: Evaluate your current health status and potential future care needs to ensure that the community you choose can provide the necessary support and care services, promoting your overall well-being.

Financial Considerations: Assess your budget and financial capabilities to determine what level of investment you can comfortably make in your retirement lifestyle, ensuring a sustainable and balanced approach that doesn’t sap your joy away with money worries.

Investing in a retirement lifestyle that prioritizes quality of life can greatly enhance your overall well-being and happiness. By evaluating and considering the lifestyle opportunities at various retirement communities, you can select the amenities, services, and social engagement opportunities that align with your needs.

As you make this important decision, take the time to identify your retirement lifestyle goals and aspirations, and select a community that enriches your life and brings you joy. After all, retirement is a time to enjoy the fruits of your labor and invest in the creation of new cherished memories.

In this comprehensive resource guide, we have explored the intricacies of managing senior living costs and highlighted the key factors to consider when planning for a financially stable retirement. Let’s recap the essential points covered in each section and reiterate the significance of understanding, planning, and utilizing professional support in managing your financial resources as an older adult.

In Section 1, we delved into the different types of senior living options and the associated costs. We emphasized the importance of researching and comparing options to make informed decisions that align with your needs and budget. By understanding the various levels of care and services offered, you can choose the right senior living arrangement that meets your requirements while being mindful of the associated costs.

Next, we addressed the unique challenge of older adults who are taking charge of their home finances for the first time or after a long while. We discussed important financial concepts, offered practical advice, and stressed the importance of seeking assistance from professionals. By understanding investment strategies, options, and insurance policies, you can make sound financial decisions that support your retirement goals.

Budgeting and financial planning are vital considerations for every retiree. We discussed the need for older adults to start personal financial plans with a clear assessment of their current finances. This lays the groundwork for estimating and comparing senior living costs and creating a financial plan for various retirement options. Finally, we go over some ways to improve income and reduce expenses in this process. Since this is not intended as financial advice, remember to review your financial plans with a certified financial professional for quality advice.

In Section 4, we explored the importance of managing health care costs in retirement. We provided some basic insights into Medicare coverage, Medicare supplement insurance, and Medicare Advantage plans. By budgeting for deductibles, copays, and coinsurance, and considering the use of a health savings account (HSA), you can better prepare for health care expenses. Additionally, we highlighted strategies to save on health care costs, such as shopping for prescriptions, utilizing preventative care services, and taking advantage of available wellness programs and discounts.

Section 5 explored strategies for saving money on senior living costs. By researching and comparing options, shopping around for the best deals, negotiating with senior living communities, looking for discounts and subsidies, and utilizing government programs, you can effectively manage your expenses and maximize your savings.

Finally, we highlighted the benefits of prioritizing quality of life in retirement by investing in a lifestyle that brings joy and fulfillment. No matter the community you choose, creating a lifestyle that provides you with the support, comfort, and convenience necessary to live your best life is a goal worth working towards. Enhance your overall well-being and happiness by selecting a retirement community that aligns with your goals, creating a delightful and enriching experience.

In conclusion, we want to reassure you that mastering the financial side of retirement is achievable and isn’t required to be a cause of excessive stress. By taking the time to understand, plan, and manage your financial resources, you can pave the way for a financially stable and enjoyable retirement. Remember to seek help from certified financial advisors, senior living associations, or non-profit organizations that offer financial advice for seniors. Resources such as AARP, the National Council on Aging, and books like “Retirement Planning for Dummies” by Matthew Krantz can provide valuable insights and further knowledge.

We greatly hope this resource and its supporting articles serve as a comprehensive guide to assist you in mastering senior living costs. By understanding the various senior living options, planning for expenses, managing health care costs, becoming comfortable with finances, saving money, and investing in a fulfilling retirement lifestyle, you will be better prepared to achieve financial stability and enjoy a comfortable and rewarding retirement.

Nov 03|Assisted Living

While Grandparent’s Day does not hit our calendars until September, we are celebrating grandparents a little earlier now that more facilities are allowing visitors. Figuring out things to do with your grandchildren can be hard if you have not seen them in a while, they have grown into new hobbies or they seemingly get bored […]

Nov 03|Assisted Living

If you think it might be time for you or a loved one to transition to a senior living community or assisted living community, there are many factors that you should take into account. Always visit a potential community in person to get a better understanding of the environment. Just like buying a house, you […]

Nov 03|Independent Living

Choosing the perfect senior living arrangement can be a daunting task. The best place for seniors to live depends on individual needs, preferences, and budget. By carefully weighing all options available concerning personal preference and quality of life standards one can find an ideal senior living option.