More results...

Dec 20, 2023|Finance & Planning

When you hear “retirement budget,” what’s your first thought? Giving up the good things in life? Let’s turn your thinking around.

Retirement budgets provide insight into your finances so you can make your post-career dollars count. The earlier you plan, the better your chances of achieving your goals. Even if you are already in your post-career years, maintaining a budget is the best retirement strategy there is.

Financial planners say you’ll likely need 80% of your pre-retirement income, but it can vary depending on your spending.

You don’t have to be an accountant or financial genius to calculate a retirement budget based on a fixed income. This article will help you create a strong budget that will consider the unexpected expenses in retirement. By estimating your monthly retirement expenses alongside your anticipated income, you’ll be well on your way to knowing how much you need to save to make your retirement years truly golden.

Statement of Fairness: Considering senior living options for yourself or a loved one? We’re here to help at every step. And even though we specialize in Independent and Assisted Living communities, our goal is for YOU to find your best path to gracious retirement living, and part of how we achieve that is by providing reliable information on all types of senior living, not just the ones we offer. When our offerings serve as useful illustrations to a specific topic, you can find that information in the attached sidebar.

Disclaimer: We Trust Professionals, So Should You: We create amazing homes for amazing people, but we are not financial advisors. This information is not intended as financial advice. We recommend always reviewing your important financial decisions with a licensed and qualified professional.

Start your budget by identifying your priorities—what you need and what you want. Compare these against your current situation and future goals for a clear roadmap.

The purpose of a retirement budget is to make you feel secure in your ability to achieve your goals. So, what are you looking for? Time with family and friends? Travel? Continuing education? Hobbies? Do you plan on staying in the same area you are living in now? In the same house?

With those things in mind, let’s estimate your expenses and income.

The monthly cost of living should add up to the total of your needs, wants and unexpected expenses. As you look at what you’re spending now, be aware that some of those bills – for example, your mortgage, loan payments and life insurance policies – may continue for only a limited number of years.

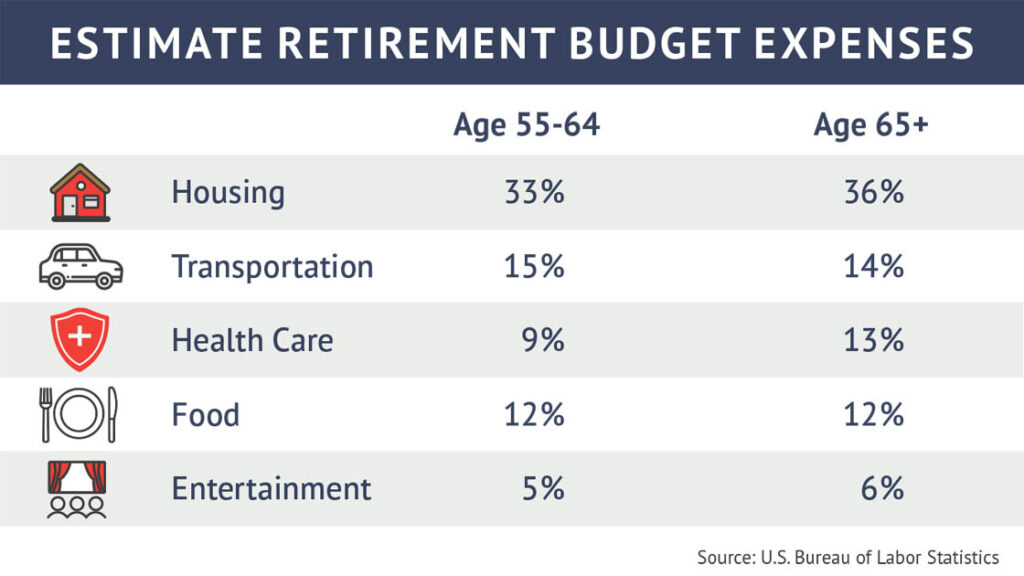

Adults 65 and older usually spend approximately $52,141 per year (averaging $4,345 per month), according to the 2021 survey by the U.S. Bureau of Labor Statistics. The cost of living tends to rise every year, but households aged 75 or more spend a bit less. Everybody is a little different, and you may have additional expenses. This list will give you an approximate idea of your income requirements for your retirement years.

Your essential needs can be divided into four categories: housing, transportation, food and health care.

Source: U.S. Bureau of Labor Statistics

Since housing represents the biggest cost, ask yourself:

If you are going to be a homeowner through your retirement years, include all your utilities, insurance premiums, maintenance and repair costs in your retirement budget. Figure 1% of your home’s value to estimate annual upkeep and repairs. If your home is worth $500,000, saving $5,000 annually for maintenance can safeguard your property without straining your finances.

Renters can assume increases in their housing budget too. While you might not be dealing with homeownership intricacies, rental expenses can fluctuate over time. Be proactive by factoring potential rent increases into your budget.

Retiring often means leaving behind the daily commute to work, leading to a substantial reduction in transportation expenses. Public transportation fares and costs associated with car upkeep and insurance can now be significantly reduced. Opting for a higher deductible can lower your monthly premiums, and combining services could result in additional savings. Exploring different options and switching providers is another avenue to discover better deals and save money without compromising on coverage.

If you’re married, you probably needed multiple cars when both of you were working. In retirement, you might decide you can manage with fewer vehicles. This would save you half the money you currently spend on gas, maintenance, repairs and insurance. If you’re considering purchasing a new car, incorporate its price or loan amount into your financial planning to ensure it aligns with your retirement goals.

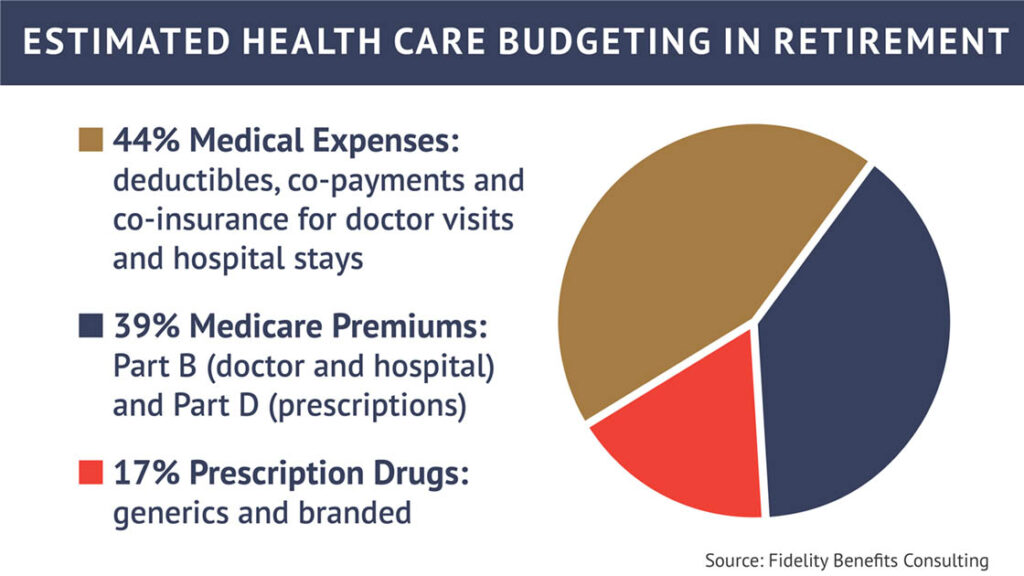

Now that we live longer, our health care spending in retirement is higher. Even with Medicare coverage starting at age 65, expenses such as Medicare deductions, supplemental insurance, prescriptions, out-of-pocket costs and medical devices add up. Visit Medicare.gov to better understand your benefits.

Fairview Estates is the kind of independent living community where lifelong friends are made. The all-inclusive monthly rent offers you a vibrant lifestyle and financial peace of mind.

“I took the leap of faith and moved in, and I’m very happy to say that I have found my new ‘adopted’ family here; caring and delightful people – each with their own stories and backgrounds to share if they wish.”

Ruth August, Fairview Estates, Massachusetts

Source: Fidelity Benefits Consulting

As reported in our research on protecting your retirement savings, a couple over the age of 65 should have anywhere between $315,000 to $587,670 in savings to cover their health care costs in retirement. A single person may need at least $157,000, according to a Fidelity Retiree Health Care Cost Estimate.

Long-term care can be financially challenging, with the average cost of a stay at a long-term care center averaging $4,500 per month. Medicare coverage for long-term care is limited, and while Medicaid offers financial assistance to those who qualify, it does not cover the entire cost.

A long-term care insurance policy can help you pay for these expenses, but the premiums for these policies can be high. It is important to consider your individual circumstances and financial situation to determine the best way to plan for long-term care costs.

Your food costs will keep pace with inflation. The inflation rate for the past ten years averages out to 2.47% per year.

The Bureau of Labor Statistics estimates that the typical American over the age of 65 spends $6,940 a year on food. Seventy percent of that amount is groceries, while the other 30% goes toward dining out. Adjust this amount according to your lifestyle in your retirement budget.

Entertainment, travel, and hobbies offer a realm of possibilities within your control during retirement. Depending on your supplemental insurance, you might even enjoy perks such as free gym memberships, enhancing both your physical and financial well-being. As you navigate the marketplace for goods and services, don’t miss out on senior discounts.

Remember, while reducing costs in this area is beneficial, we don’t want to eliminate these expenses, as they contribute to overall well-being and fulfillment. Social isolation, according to The National Institute on Aging, is associated with increased health risks, including heart disease, high blood pressure and a weakened immune system.

While being mindful of your retirement budget, consider the invaluable returns that investments in entertainment, travel and hobbies can yield for your health and happiness. Finding that sweet spot where you optimize your financial resources while fostering social connections is key to a fulfilling and well-rounded retirement lifestyle.

Dive into your revenue streams and add them up.

The earlier you retire, the less time you have to build up your golden nest egg. You’ll also need more money to carry you through those extra years. A certified financial planner can help you estimate what your total worth will be at your desired retirement age.

Before you start a sample retirement budget, take a few months to track spending and savings trends. Look at your financial picture over time rather than a quick snapshot.

As you forecast the income you will realize from your investments, use The Rule of 72. Divide 72 by the expected annual rate of return on your investment. For example, if your rate is 8%, it would take nine years until that amount would double. (72 divided by 8 equals 9.) If you invested $10,000 at a rate of 8%, it would take nine years to turn that amount close to $20,000.

To understand how much money you can safely withdraw from investments each month, use the 4% Rule.

The next year you can withdraw 4% again but add in a small increase for the cost of inflation. This retirement budget strategy should help your investments last.

Many financial websites have a retirement budget planning tool or you can talk to a certified financial planner. The more you know, the better you’ll understand, empowering you with knowledge for a bright retirement.

You can’t foresee life’s challenges, and retirement can bring unexpected expenses just like before. Medical costs, long-term care, losing a spouse, investment market changes, inflation and even a grandchild’s wedding can strain your retirement budget.

Life throws us curveballs, and that’s okay. When unexpected expenses pop up, it’s time to revisit your budget. Think of it like giving your financial plan a tune-up. You might need to temporarily tighten your belt or explore ways to boost your income. But don’t panic; it’s just a matter of getting your budget back on track. Remember, your budget is a living document, meant to adapt to life’s ups and downs.

Here are some proactive tips to help you prepare for unexpected retirement costs:

Review your budget periodically and even try it out for several months. If you’re not retired now, see if you can live comfortably on the amounts you have set. Put the extra dollars into your savings or pay off debts. If you are retired, track your expenses and income every month and compare the amounts.

A financial planner can help you manage the economic factors that might affect your income. Low interest rates, changes in the stock market and inflation can all put a dent in your savings. Rebalancing your portfolio will help keep you on a positive course.

Money management is a skill you can master. Knowing how to create and stick to a budget will give you the financial edge during retirement. Comparing expenses to income and planning for the unexpected will give you control and confidence during retirement.

Make everyday moments special experiences.

The Rio Grande is your place to thrive in mind, body and spirit. Count on our monthly rate to make your retirement budget work.

“I enjoy being sociable in the dining room while eating delicious meals. The activities and games provide great entertainment and amusement.”

Chris Merrek, The Rio Grande, New Mexico

Disclaimer: This content is not intended as financial advice. Remember to review your plans and budgets with a licensed financial professional when making significant financial decisions.

Dec 27|Finance & Planning

Dec 13|Finance & Planning

Nov 29|Finance & Planning