Facing the need for senior care can be a complex and emotional journey. We all yearn for our loved ones to thrive in environments that nurture their well-being and offer the support they deserve. Yet, navigating the diverse landscape of care options can feel overwhelming, shrouded in uncertainty and anxieties about the future.

It’s natural to worry about the impact on your loved one’s independence, comfort and sense of self. These concerns are valid, and we acknowledge the vulnerability that comes with finding the right fit. We understand that choosing the right care level is not just about ticking boxes; it’s about honoring individual needs and aspirations while ensuring a life filled with dignity and joy.

Our goal is to provide you with the knowledge and understanding you need to make the best choice for your loved one. We’ll explore the different types of senior care, their benefits and limitations, and offer practical tips to help you evaluate each option through the lens of your loved one’s unique needs and preferences.

Statement of Fairness: Considering senior living options for yourself or a loved one? We’re here to help at every step. And even though we specialize in Independent and Assisted Living communities, our goal is for YOU to find your best path to gracious retirement living, and part of how we achieve that is by providing reliable information on all types of senior living, not just the ones we offer. When our offerings serve as useful illustrations to a specific topic, you can find that information in the attached sidebar.

What’s the best way to choose the right level of care?

Balance your loved one’s need for support alongside their desire for independence. Consider safety but give them the freedom to do what they can for as long as they can. Maintaining self-worth and personal agency boosts feelings of well-being and improves quality of life.

The key to success is thinking ahead. Know your senior care options and the kinds of needs they support. Having a plan in place will keep your family from being forced to decide under pressure.

What are the options for senior living?

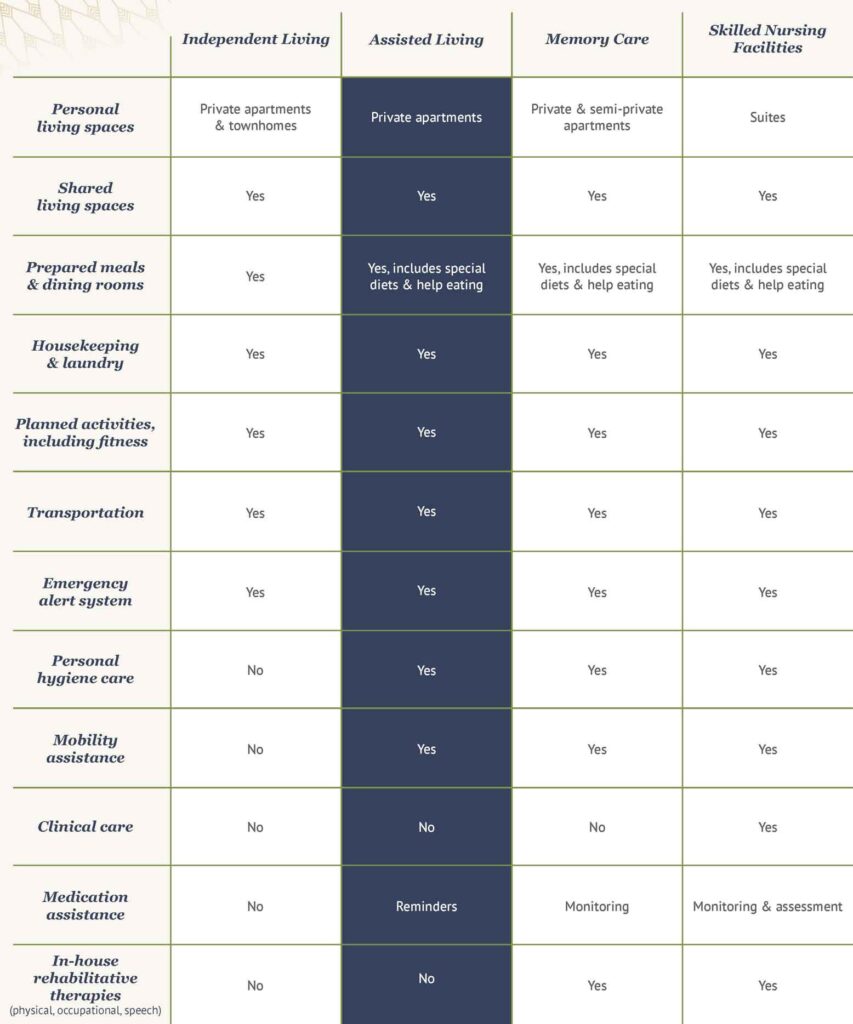

Retirement communities offer maintenance-free living in safe, age-friendly homes designed for adults aged 55 and older. An enriching lifestyle along with healthy dining creates a nurturing, social atmosphere that promotes a positive quality of life.

Independent Senior Living

These communities feature a range of housing options, from apartments to freestanding homes, providing a comfortable lifestyle. Residents in independent living have the freedom to maintain autonomy in their lifestyle with the support of family or through services that allow them to achieve independence through outside care. Independent living empowers older adults to access assistance when they need it and stay fully in charge of their health decisions in the living situation that feels right for them.

Assisted Living

Assisted living residents benefit from the same amenities but have an individualized care plan that lists extra services to help them with the activities of daily living.

Skilled Nursing Facilities

Patients receive hospital-level care from trained medical staff. Skilled nursing can provide:

- Physical therapy

- Occupational therapy

- Speech therapy

- IV therapy

- Post-stroke, after-surgery and cardiac care

Memory Care

This level of senior care provides maximum personal assistance in a structured, secure environment for those diagnosed with dementia, Alzheimer’s disease and other cognitive difficulties.

In-Home Health Care

For seniors choosing to live at home, trained professionals bring medical care to their door.

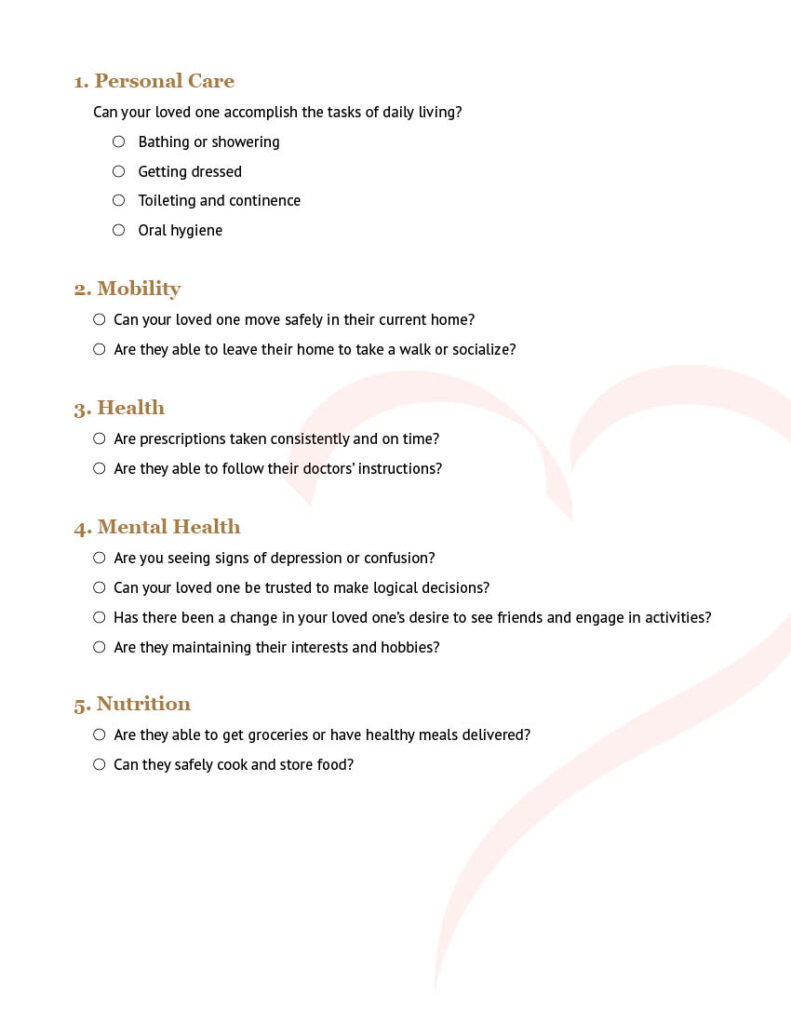

How do you determine the right level of care?

As you weigh what level of care your loved one needs, consider these five areas.

Based on your answers to this informal needs assessment, you can determine if the best situation is:

- Independent senior living. Your loved one desires the freedom to maintain autonomy in their lifestyle with optional support from family or third-party services. They remain in charge of their health decisions and can access their choice of assistance then they need it.

- Assisted living or in-home health. Your loved one needs minimal assistance and supervision with daily activities like preparing meals and medication management. They can safely move around their home environment with the help of a walker or wheelchair, and they have good thinking and communication skills.

- Assisted living, in-home health or skilled nursing facility. Your loved one requires hands-on daily assistance such as physical lifting, bathing and help with the tasks of daily living.

- Skilled nursing or a memory care community. Your loved one requires maximum support with a caregiver doing most tasks for them.

Key factors in choosing a senior care option

You’re not alone in making this decision. Get input from your loved one and family members.

Quality of life

Some older adults thrive on the buzz of a big, social community. Others look for quieter one-on-one times and even a touch of solitude now and then. Natural landscapes or city streets? Arts and crafts or sports and physical activities? Retirement communities have monthly calendars of activities that will show you the themes and types of wellness that community supports.

Care and Support

In assisted living, skilled nursing and memory care facilities, health care professionals and staff members work together on a needs assessment to create a personalized senior care plan. Mobility, medical conditions, fine motor skills, mental acuity, mood and awareness all play roles in this assessment.

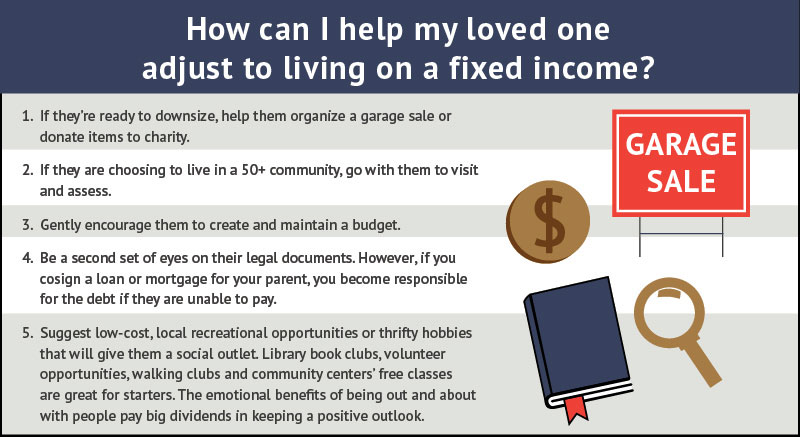

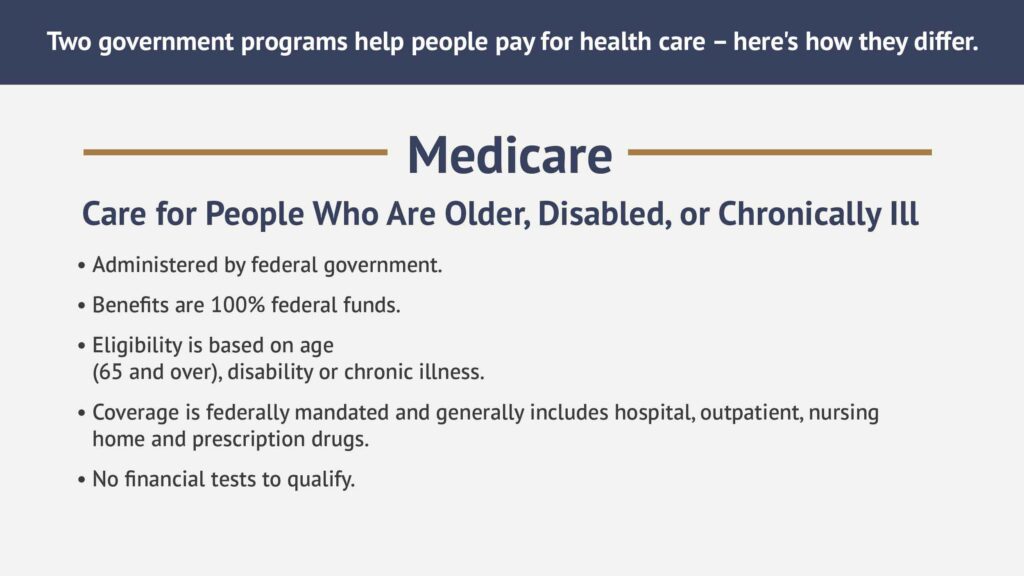

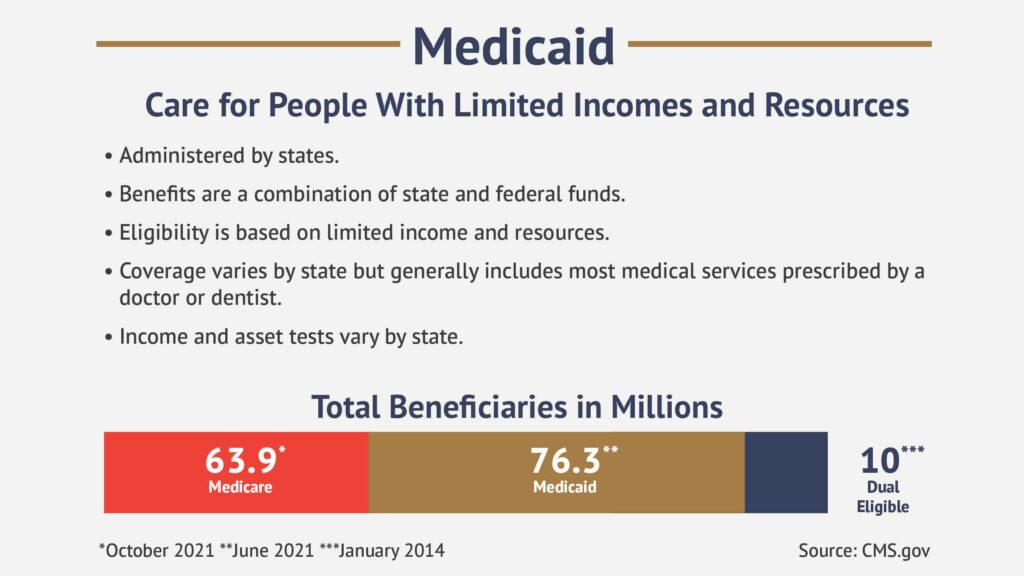

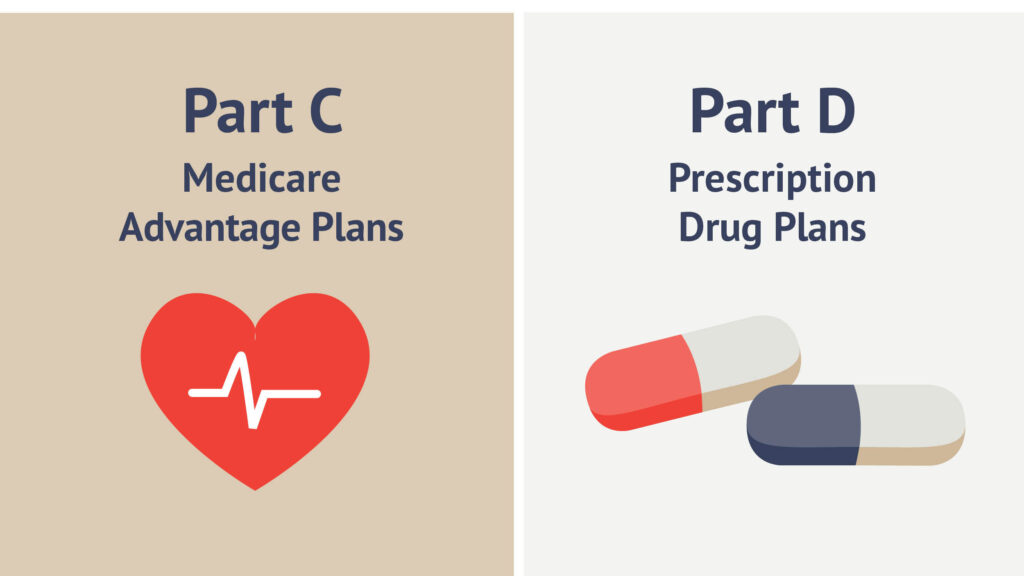

Budget Considerations and Financial Planning

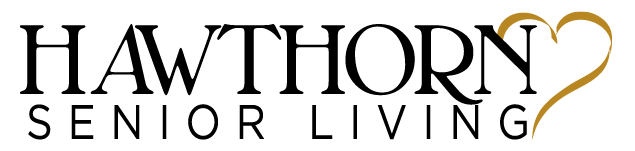

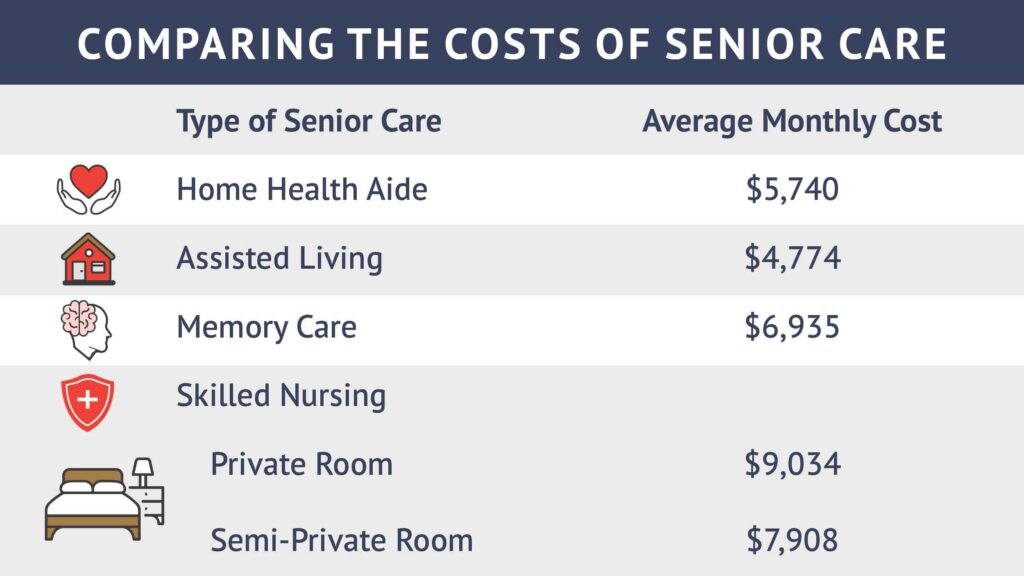

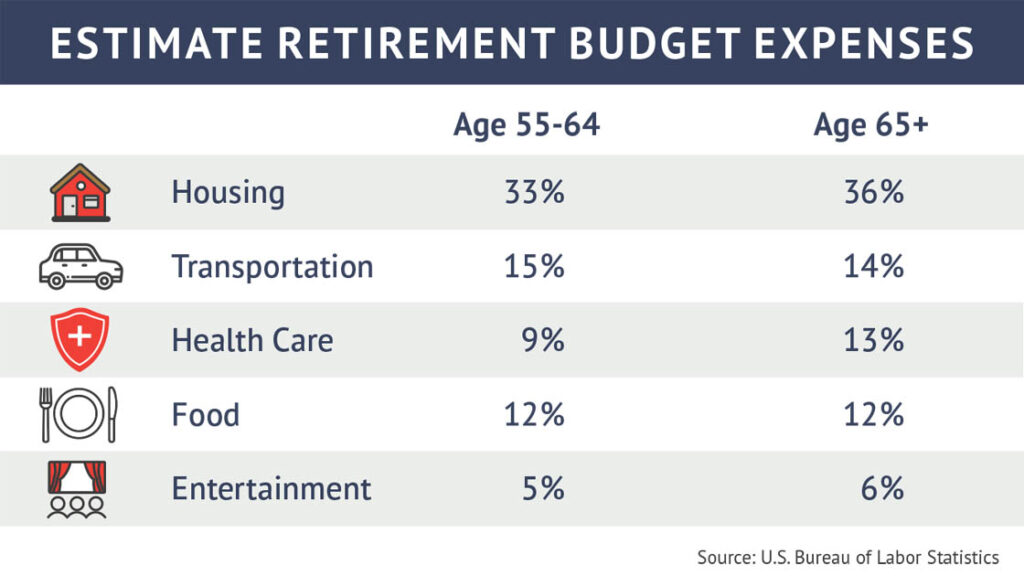

The key to affording senior care options is thinking long-term. Plan for annual rises in costs. Combining retirement income, savings and investments, along with funding from Medicaid or Veteran’s (VA) benefits, will get you started on a realistic budget. As the need for more assistance arises, the cost of senior living increases.

Legal and Contractual Aspects of Care Arrangements

When hiring in-home health or moving into independent senior living, assisted living, skilled nursing facility, or a memory care community, you will be asked to sign contractual agreements that will cover what will be provided, the financial responsibilities, and liabilities. Although the documents are long, read them carefully and consult a lawyer if necessary.

Professional Advice

Talk to people you trust.

- Start with your loved one’s health care team. Attend appointments and check-ups as often as possible. Many hospitals have social workers on staff who can provide resources and counseling.

- Ask a lawyer to review senior care contracts, and know your rights.

- Enlist the aid of a financial planner or other knowledgeable professional to help you determine how much of the out-of-pocket costs you can handle.

- Your local Eldercare can provide advice and connect you to services. They can answer questions about insurance and benefits, support services, housing, and legal rights.

Now that you’re familiar with your options for senior care, schedule visits to see these communities in action. Bring along your loved one and other family members and friends. Whether independent living, assisted living, skilled nursing, memory care or in-home care turns out to be the best fit for your loved one, you’ll feel confident you’re making the right choice at the right time.

Many families formalize agreements with family members. Caregiver contracts provide hourly wages to a relative or friend for at-home services. Talk to a lawyer about setting this up.