Retirement is a time to relax and enjoy life, free from the demands of work. It’s also a time when we naturally focus more on our health and well-being, both physical and financial. One important aspect of retirement planning is anticipating and managing health care costs. While we can’t predict exactly how much we’ll need for health care expenses in retirement, it’s helpful to consider factors like insurance premiums, potential out-of-pocket expenses and common medical costs. Fortunately, there are strategies to proactively manage and potentially reduce these expenses.

Our goal is to empower you with the knowledge and tools needed to make informed decisions, so you can plan for your health care expenses with confidence. Whether you’re about to retire or have already taken that leap, this guide will provide valuable insights and strategies that can help you achieve a secure retirement.

Statement of Fairness: Considering senior living options for yourself or a loved one? We’re here to help at every step. And even though we specialize in independent living communities, our goal is for YOU to find your best path to gracious retirement living, and part of how we achieve that is by providing reliable information on all types of senior living, not just the ones we offer. When our offerings serve as useful illustrations to a specific topic, you can find that information in the attached sidebar.

Disclaimer: This content is not intended as financial advice. Remember to review your plans and budgets with a licensed financial professional when making significant financial decisions.

The Importance of Health Insurance in Retirement

Health insurance is your safety net. As we age, health risks increase, and so do medical care costs. That’s why it’s important to have health insurance in retirement. Health insurance can help you cover the costs of a wide range of medical expenses, including:

- Doctor visits

- Hospital stays

- Prescription drugs

- Preventative care services

Without health insurance, you could be on the hook for thousands of dollars in medical expenses, which could quickly deplete your retirement savings. There are several different health insurance options available to retirees. You can purchase a plan through the Health Insurance Marketplace, or you may be eligible for retiree health insurance through your former employer. If you’re not sure which option is right for you, you can talk to a health insurance agent or broker.

Here are some tips for choosing a health insurance plan in retirement:

- Consider your health needs. What are your current health concerns? Do you have any chronic health conditions? Who is your current health provider, and do you want to continue seeing them? What extra benefits are important to you (i.e., dental, vision, hearing, etc.)?

- Compare different plans. Once you know what you need, compare different plans to find the one that’s right for you. Consider the cost of the plan, the benefits it covers, and the network of doctors and hospitals it includes.

- Talk to a financial advisor. A financial advisor can help you understand your health insurance options and choose a plan that fits your budget and retirement goals.

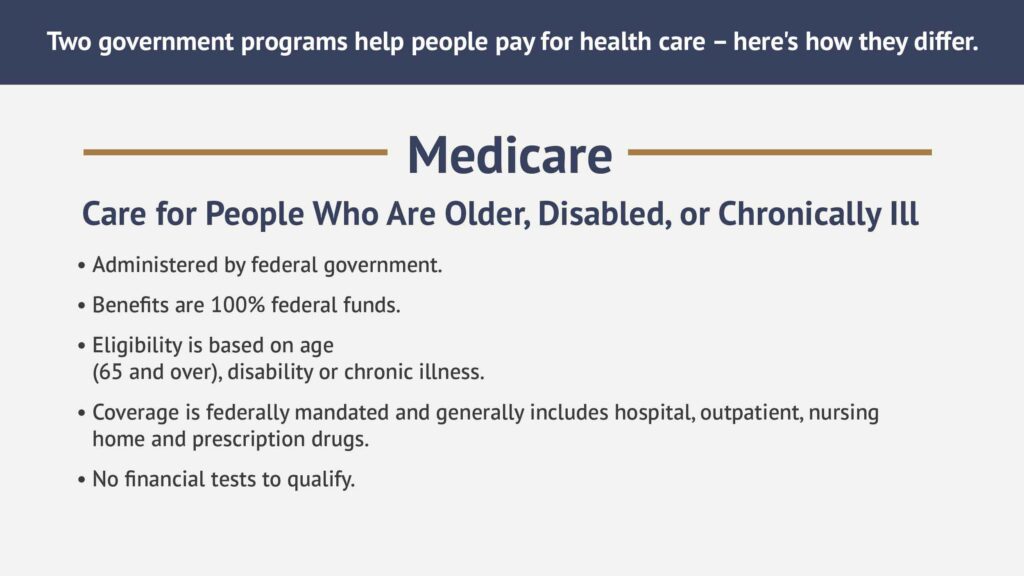

Medicare and Medicaid Coverage

Understanding the intricacies of programs like Medicare and Medicaid is crucial to ensuring comprehensive and affordable health care. These two government programs can help you pay for essential health care costs, but they have different eligibility requirements and benefits.

What is Medicare?

Medicare is a federal health insurance program for individuals aged 65 and older. The Initial enrollment period to sign up for Medicare begins three months before you turn 65 and ends three months after the month you turned 65. Visit Medicare.gov for more information about the enrollment process. You can even answer a few simple questions to determine when you should sign up and how to sign up.

Medicare consists of different parts, each covering specific services:

- Part A – Hospital Insurance: Covers inpatient hospital stays, skilled nursing facility care, hospice care and some home health care.

- Part B – Medical Insurance: Covers outpatient care, doctor visits, preventive services and some home health care.

- Part C – Medicare Advantage Plans: Private insurance plans approved by Medicare, often covering Part A, Part B and sometimes Part D benefits.

- Part D – Prescription Drug Coverage: Helps cover the cost of prescription medications.

Since Medicare doesn’t cover all expenses, many adults purchase Medigap policies to fill the gaps in coverage. These supplemental insurance plans can help with copayments, deductibles and other out-of-pocket costs.

What is Medicaid?

Medicaid is a joint federal and state program that provides health coverage for individuals and families with low incomes, including seniors with limited resources. Medicaid covers a broader range of services than Medicare, including long-term care. Each state has its own Medicaid program, so eligibility requirements vary. However, there are some general requirements, such as income and asset limits.

You can learn more about Medicare and Medicaid on the websites of the Centers for Medicare & Medicaid Services (CMS) and your state Medicaid agency.

Common Medical Expenses in Retirement

Insurance premiums and deductibles: An insurance premium is the regular payment you make to an insurance company to maintain your coverage. In the context of retirement, you may encounter various types of insurance premiums, including health, dental, vision, life, and long-term care insurance premiums. The amount of your premium depends on several factors, including your age, your health and the type of insurance coverage you have. A deductible is the initial amount you must pay out of your own pocket for covered services or expenses before your insurance coverage kicks in.

How are the insurance premiums and deductibles linked? In most cases, if a health plan has a higher deductible, it comes with a lower monthly premium. By being prepared to cover more of your health care costs up front when necessary, you can reduce your monthly expenses.

Prescription drugs: Prescription drugs can be another significant expense in retirement. Medicare Part D helps cover prescription drug costs, but it has a monthly premium and deductible. You may also need to pay copays and coinsurance for some drugs. Research generic alternatives to save on costs whenever possible. The Food and Drug Administration (FDA) has a searchable database of all FDA-approved drugs. You can search by brand name or active ingredient for availability of generic alternatives. Then, you can talk to your doctor and pharmacist to make sure you’re getting generic prescriptions when possible.

Long-term care: Long-term care is the type of care you need if you are unable to perform activities of daily living (ADLs) on your own, such as bathing, dressing, and eating. Medicare does not cover long-term care, so you will need to pay for it out of pocket or with long-term care insurance.

Dental and vision care: Medicare and other forms of insurance do not cover dental or vision care. This includes importance services like routine dental check-ups and cleanings, eye exams, prescription glasses and extensive procedures. Dental and vision insurance plans can help to offset the cost of preventive care and major procedures. There are a variety of plans available, so it is important to compare coverage and premiums before choosing a plan.

Out-of-pocket expenses: Even with insurance, many adults may have to pay for over-the-counter medications such as pain relievers and allergy medications; medical equipment, such as a wheelchair or walker; hearing aids; and transportation to and from medical appointments. While these expenses may seem small, they can add up over time. It is important to include these costs in your financial plan so that you are prepared to pay for them.

Long-Term Care Insurance Options

As mentioned above, Medicare does not cover long-term care. While we think we won’t need it, having long-term care insurance (LTCI) is a wise decision for the future, especially if the need for long-term care arises unexpectedly. The best time to buy LTCI is when you’re healthy and relatively young. Premiums are lower for younger people, and you’re more likely to be approved for a policy. LTCI policies can help you cover the expensive costs associated with skilled nursing care, assisted living and in-home care.

There are two main types of LTCI:

- Traditional LTCI: This type of policy covers the cost of long-term care services up to a certain amount of money, usually per day or month. You can choose how long you want to be covered for, and you can also choose a waiting period, which is the amount of time you must wait before your coverage begins.

- Hybrid LTCI: This type of policy combines LTCI coverage with another type of insurance, such as life insurance or an annuity. Hybrid policies can be more complex than traditional LTCI policies, but they can also be more flexible and affordable.

Ways To Reduce Health Care Costs in Retirement

The average American couple aged 65 and older can expect to spend an estimated $300,000 on health care expenses in retirement. The good news is that there are steps you can take to reduce your costs. Here are a few tips:

- Plan ahead. The earlier you start planning for health care costs, the better. This will give you more time to save money and find ways to reduce your expenses. You can also estimate costs by using a retirement calculator. This will help you determine how much money you need to save for health care in retirement.

- Enroll in Medicare as soon as you are eligible. Understanding the enrollment periods and signing up on time ensures you have comprehensive coverage.

- Shop around and compare prices of services and medications. By comparing prices, you can identify more affordable options, potentially saving you hundreds or even thousands of dollars annually.

- Prioritize your health and wellness. This means eating a healthy diet, exercising regularly and getting regular preventive care checkups.

- Take advantage of discounts, coupons and loyalty programs. Pharmacy chains often have loyalty programs that reward you for your patronage. These programs provide discounts on medications, vaccinations and even daily essentials. Understanding how to access and use these programs can make a big difference in your budget.

- Tax Deductions. Certain health care expenses are tax-deductible. Learn which medical expenses qualify for tax deductions and how to maximize your savings during tax season.

- Invest in an HSA (Health Savings Account). An HSA allows you to save pre-tax money for medical expenses, providing a financial cushion for health care costs.

Start Today

Anticipating and managing health care expenses in retirement requires careful planning, but it’s a fundamental aspect of ensuring a secure and fulfilling retirement. By understanding your current and potential health care needs, evaluating insurance options, budgeting effectively, and planning for long-term care, you can navigate the complexities of health care expenses with confidence. Remember, your health and well-being are invaluable assets – investing time and effort into understanding and managing your health care costs is an investment in a healthy and prosperous retirement.

Disclaimer: This content is not intended as financial advice. Remember to review your plans and budgets with a licensed financial professional when making significant financial decisions.

DID YOU ENJOY WHAT YOU JUST READ?

Join our exclusive community and subscribe now for the latest news delivered straight to your inbox. By clicking Subscribe, you confirm that you agree to our terms and conditions.

Cut Costs at Alexis Estates

The gracious retirement lifestyle at Alexis Estates Gracious Retirement Living focuses not only on personal wellness but on caring relationships too. Our resident transportation services get our residents where they need to go and is included in the monthly rent. From transportation to and from scheduled health care appointments to fun outings with other residents, residents can save money on vehicle maintenance and spend more time enjoying their retirement.

Live Well at Glenmoore Independent Living

Glenmoore Gracious Retirement Living features an active lifestyle, with a full complement of amenities and services so you can enjoy your retirement and spend more time with family and friends. Our independent lifestyle includes a live-in management team that is available throughout the day, a robust wellness program with daily activities and events, and flavorful, healthy chef-prepared meals.

UP NEXT

14 min read

Comparing the Monthly Costs of Senior Living

Learn about various types of senior living and what those may cost as well as ways to cut costs for care services and manage costs long-term.

Frequently Asked Questions:

How can I protect my retirement savings from unexpected health care expenses?

You can protect your retirement savings by planning ahead for health care costs, enrolling in Medicare as soon as you are eligible, shopping around for the best insurance plans, and considering supplemental coverage like Medigap or Medicare Advantage. Using tax-advantaged accounts such as Health Savings Accounts (HSAs) and exploring long-term care insurance can also help manage and reduce out-of-pocket expenses.

What types of health insurance should I consider in retirement?

Key options include Medicare (parts A, B, C and D), Medigap policies to cover gaps in Medicare, and long-term care insurance for services not covered by Medicare. Dental and vision care often require separate insurance plans, as they are not included in standard Medicare plans. Comparing different plans based on your health needs, provider networks and costs is essential for comprehensive coverage.

Are there ways to reduce health care costs during retirement?

Yes, you can reduce costs by prioritizing preventive care, maintaining a healthy lifestyle, using generic prescription drugs, taking advantage of pharmacy loyalty programs and maximizing tax deductions for medical expenses. Planning for out-of-pocket costs such as over-the-counter medications and medical equipment is also important.

FIND YOUR COMMUNITY

Related Articles

STORIES, INSIGHTS & RESOURCES

As you and your loved ones navigate the exciting opportunities retirement presents, thoughtful planning is key. Stay informed with empowering articles for seniors covering health, lifestyle, finance and more.

Chronicles Of The Heart

RESIDENTS SAY INDEPENDENCE IS A TOP PRIORITY

Below, residents explain how much they appreciate the freedom they experience at our independent living community. It’s empowering to continue to make your own decisions, and you’re free to create your day around your personal interests.