How do you know if you’re saving enough for retirement? It’s a question we ask ourselves often. We all want our golden years to be stress-free, but the financial planning part can be confusing. If you’ve ever wondered how to ensure your retirement nest egg not only lasts but thrives, you’re in the right place. This isn’t about pinching pennies; it’s about finding ways to make your money go further.

Financial planners estimate that you will be spending 70% to 80% less during your retirement years than while you were working, so now you must consider if your savings, investments and Social Security will add up to the lifestyle you desire.

What is a realistic budget for retirement? There’s no one-size-fits-all strategy that will work for everyone, but we can all use a good financial tune-up from time to time. In this blog, you’ll learn practical strategies, smart budgeting tips and lifestyle adjustments that empower you to trim unnecessary expenses while safeguarding your retirement goals, even on a fixed income.

Statement of Fairness: Considering senior living options for yourself or a loved one? We’re here to help at every step. And even though we specialize in independent living communities, our goal is for YOU to find your best path to gracious retirement living, and part of how we achieve that is by providing reliable information on all types of senior living, not just the ones we offer. When our offerings serve as useful illustrations to a specific topic, you can find that information in the attached sidebar.

Disclaimer: This content is not intended as financial advice. Remember to review your plans and budgets with a licensed financial professional when making significant financial decisions.

Cost-Cutting Strategies: Living at Home or Moving to a Retirement Community?

Aging In Place

The desire to remain at home as we age, also known as aging in place, holds great appeal. But certain costs come with it. If you are seeking to remain in your home, you’ll have to budget for groceries, transportation, home safety and accessibility modifications, social activities, and home health care. While aging in place can be a viable option, it’s crucial to approach it with realistic expectations and careful planning.

Another idea to consider is downsizing in the retirement years. Housing costs represent the biggest personal budget expenditure. A smaller home comes with lower utility and maintenance costs. Using assets to pay off a mortgage eliminates a hefty monthly bill.

Senior Living

A move to a retirement community can be rich in financial, physical and emotional benefits. Some independent living communities offer an all-inclusive monthly fee that covers rent, meals, amenities, transportation and recreation.

Not only will you know what you’ll be spending monthly, but you’ll be enjoying an active lifestyle in an enriched environment created especially for older adults. The proceeds from selling a house is one way to pay for a senior living community.

What Does Long-Term Care Insurance Cover?

Long-term care is for individuals who need help with the activities of daily living such as eating, dressing and bathing. These services can be provided through in-home support agencies or given in a residential community. A long-term care insurance policy pays for the services that Medicare doesn’t cover.

The younger you are when you purchase long-term care insurance, the lower your premiums will be. However, getting a policy at an older age – for example, 60 to 65 – may offer better affordability with higher premiums but less total dollars paid. In other words, while premiums may be higher if you purchase a long-term care policy at an older age, you may still save money in the long run because you will pay premiums for a shorter period of time.

How Can I Cut the Costs of Long-Term Care?

- Enroll in Medicare as soon as you qualify. Your initial enrollment period begins when you turn 65. You can start the process as early as three months before your birthday, and the period ends three months after the month you turn 65. Medicare will pay for care in a skilled nursing facility for 100 days.

- Read more about Medicare benefits by downloading Medicare and Home Health Care.

- Explore Supplemental and Advantage insurance plans. You will pay monthly premiums based on the policy you choose, but they help pay for medical costs that Medicare does not. Some plans offer extra coverage for hearing, dental, vision and even gym memberships.

- Medicare drug coverage (Part D) can help with the cost of prescription drugs. Review your plan to see if your specific prescriptions are covered. Ask your pharmacist about coupons and other savings programs you can use.

- If you’re under 65, contribute to a health savings account (HSA). This is available to you through banks, credit unions and other financial institutions even if you’re not working. Your pre-tax contributions can be withdrawn tax-free and used for qualified medical expenses that include long-term care, doctor visits, prescriptions, ambulance costs, psychiatric care and more.

Are There Ways to Negotiate the Costs of Long-Term Care?

With life expectancies going up, so are the costs of support services people might need at an older age. That bill can exceed thousands of dollars per month with estimates that range from $1,603 for adult day care to $8,821 for a skilled nursing private room.

Skilled nursing communities typically do not negotiate their rates, but assisted living communities might. What you will pay depends on the kind and level of care needed in the geographic area where you live. You can calculate estimates for your city in the Cost of Care Survey.

Healthier lifestyles lead to better outcomes, no matter what age you are. Talking to your doctor, eating right, getting enough sleep and exercising all contribute to a better you. Keeping yourself in the best physical condition possible could lessen or delay your need for long-term care.

What Is the Best Fixed-Income Strategy?

The simple answer is planning and budgeting.

People spend the most money on housing, transportation and food. No surprise there, but in order to understand where your dollars are going, write down every purchase and payment you make, no matter how small. Whether it’s a cup of coffee or a major home improvement project, keep track.

Divide your expenses into Needs, Wants and Savings/Debt Payment.

What is your income? Add up:

- Social Security

- Supplemental Security Income (SSI)

- Pensions

- Withdrawals from 401(k) or 403(b) plans

- Part-time salaries

- Income from rental properties and other sources

With your income total, allocate 50% to Needs, 30% to Wants and 20% to Savings/Debt Payment. How do your spending and income numbers match up? This exercise can be a real eye-opener and point to areas where cost-cutting is needed.

If you’re still employed, start saving early and contribute to individual retirement accounts that work to your tax advantage.

Where Can I Find Financial Assistance Programs and Other Resources?

Take heart. There’s help.

- Increases in Social Security benefits help people on a fixed income keep pace with the cost of living and offset the rising price of goods and services.

- The National Council on Aging offers a comprehensive guide called Resources and Support for Older Adults Living Alone that points you to organizations offering services and programs that help older adults receive financial assistance and health care support.

- Meals on Wheels and other nutrition programs are available in almost every American community.

- Your local Eldercare program, a public service of the U.S. Administration on Aging, is ready to help you with your transportation and housing needs. It’s a safe resource to answer your questions about insurance, benefits and your legal rights.

- Senior discounts are everywhere. If you don’t see it on a sign, ask.

- Joining AARP can help you lower costs on everything from Medicare supplemental insurance to hotels and restaurants.

- Many counties and cities offer property tax relief to adults 65 and older who meet income requirements. Ask your local government official.

And don’t forget about good old coupons. While they might not be in the newspaper anymore, you’ll find them in abundance online. When you’re on a fixed income, saving pennies turn into dollars back in your pocket.

How Can I Cut Back on Spending When I’m on a Fixed Income?

If you’ve created your budget, you know where you’re spending your money. Now you can make thoughtful changes, not painful ones.

- If you’re living with a spouse or partner, do you really need two cars anymore? Now that you’re in your post-career years, you can easily cut the cost of gas, maintenance and insurance in half.

- You can lower your home and auto insurance by paying a higher insurance deductible. If that’s a risk you’re willing to take, you’ll pay less each month. Shop around for a less expensive policy. The insurance business is highly competitive, and the differences in rates may surprise you.

- Now that you have a fixed income, make your best effort to pay down any debt. Refinance your mortgage if there’s a lower rate available, downsize or move to a senior community within your means.

- Are there life insurance policies you no longer need? Cashing those in may give you the extra funds to pay off other debts.

- You may be paying for fees that are taking money out of your investments. Review your financial statements, and if the fees aren’t stated plainly, give the bank or institution a call.

- Internet, cable and streaming costs keep creeping up. If you’re not enjoying or watching some of those channels, cancel them. Call your provider and ask if you’re eligible for the Affordable Connectivity Program. The ACP is a federally funded program that could decrease your bill by $30 or more.

- Vacations are not out of the question. Significant savings can be had if travel time is scheduled during the off-season. As a bonus, there will be fewer tourists competing to see the same attractions.

How Can I Stop Stressing About Money?

If you made a budget and found ways to spend less, you’re on your way to managing your money better. But money matters can still be an emotional issue. Talking to a financial planner can put your mind at rest.

Having a power of attorney document in place will give you and your loved ones peace of mind. A power of attorney gives another person the authority to act on your behalf in specified or all legal matters. That way, if you become unable to pay your bills due to illness, the person you name as power of attorney can make sure everything is dealt with on time.

Take stock of your life and set your priorities. What are the experiences and things that give you a sense of purpose? Be mindful of how you spend your time.

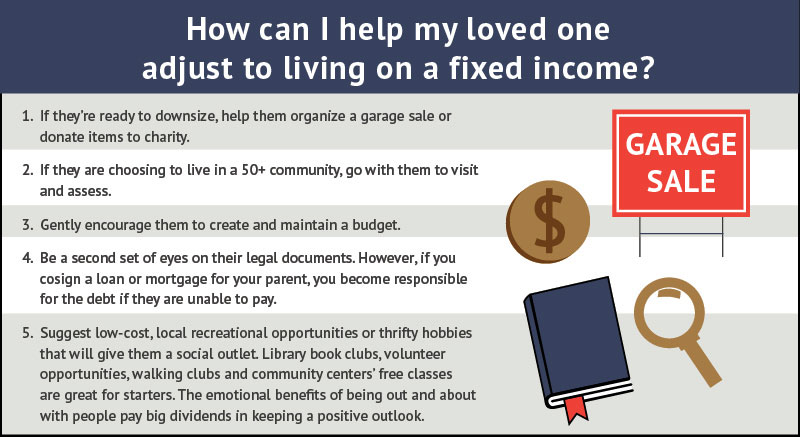

How Can I Help My Loved One Adjust to Living on a Fixed Income?

After all their years of nurturing support, you want to be there for your loved one during these important years. Here are five ways to help without becoming responsible for their bills.

Unlock Your Financial Security

No grand secret exists to maximizing your retirement savings. Safeguard your hard-earned dollars by using common-sense budgeting strategies and trimming unnecessary expenses. Arm yourself with knowledge and take advantage of the benefits and financial programs designed for older adults living on a fixed income.

DID YOU ENJOY WHAT YOU JUST READ?

Join our exclusive community and subscribe now for the latest news delivered straight to your inbox. By clicking Subscribe, you confirm that you agree to our terms and conditions.

Discover a healthy lifestyle that comes with one all-inclusive fee

At Ashton Gardens Gracious Retirement Living, our focus is your health and wellness. Enjoy nutritious chef-prepared meals, trivia nights, or a variety of social and fitness opportunities that benefit your complete well-being, knowing your monthly budget is set.

Stretch Your Retirement Budget

The gracious retirement lifestyle at Colonial Harbor features predictable monthly expenses with a full complement of amenities and services, so you can enjoy your retirement and spend more time with family and friends. Included in the all-inclusive monthly rent, our residents receive:

- A private apartment with a choice of multiple floor plans

- A private apartment with a choice of multiple floor plans

- Three chef-prepared meals daily

- Weekly housekeeping and linen service

- Planned activities and social events

- Basic cable service

- Utilities (electricity, gas, water and sewer)

- Local transportation

Vacation With the Comfort of Home

Taking time away from home can be a much-needed but costly expenditure. At The Highlands Gracious Retirement Living, residents can take part in a unique travel program where they can stay up to seven nights in a comfortable guest suite at one of more than 70 Hawthorn communities across the country. Each stay includes meals and participation in enrichment programs and activities just like at home – all at no additional cost.

UP NEXT

11 min read

How Independent Senior Living Can Stretch Your Retirement Budget

Explore how choosing all-inclusive independent living can save you money in the long run, from reduced maintenance costs to included amenities and services. The key to gaining financial freedom in your retirement is to find a balance between your desired lifestyle and financial security.

Frequently Asked Questions:

What are some effective ways to cut costs during retirement?

There are several strategies to reduce expenses in retirement, such as downsizing to a smaller home to lower utility and maintenance costs, paying off your mortgage to eliminate monthly payments, and carefully budgeting for groceries, transportation, and home modifications if you plan to age in place. Moving to a retirement community with an all-inclusive monthly fee can also help manage costs by covering housing, meals, amenities and more in one predictable payment.

How can I manage health care and long-term care expenses on a fixed income?

To manage health care costs, enroll in Medicare as soon as you qualify and consider supplemental or Advantage insurance plans to cover services that Medicare does not. Medicare Part D can help with prescription drug costs, and using a health savings account (HSA) before age 65 can provide tax-free funds for medical expenses. For long-term care, purchasing long-term care insurance at a younger age can result in lower premiums, but even purchasing at age 60 – 65 may be cost-effective because you’ll pay for a shorter period.

What budgeting tips can help me live comfortably on a fixed income in retirement?

Start by tracking all your expenses and dividing them into needs, wants and savings/debt payments. Aim to allocate 50 percent of your income to needs, 30 percent to wants and 20 percent to savings or debt repayment. Review recurring expenses like insurance, internet and streaming services for potential savings, and consider reducing the number of vehicles you own or refinancing your mortgage. Paying down debt and canceling unnecessary subscriptions can also free up funds for more important needs.

FIND YOUR COMMUNITY

Related Articles

STORIES, INSIGHTS & RESOURCES

As you and your loved ones navigate the exciting opportunities retirement presents, thoughtful planning is key. Stay informed with empowering articles for seniors covering health, lifestyle, finance and more.

Chronicles Of The Heart

RESIDENTS SAY INDEPENDENCE IS A TOP PRIORITY

Below, residents explain how much they appreciate the freedom they experience at our independent living community. It’s empowering to continue to make your own decisions, and you’re free to create your day around your personal interests.