If your loved one is 65 years or older, there’s a 70% chance they will someday need long-term care services. With the price of senior living continuing to rise, financial comparisons play a crucial role in deciding the right path forward.

As you search for the ideal retirement community, you’ll discover a wide range of choices, from luxury villas to modestly comfortable living spaces. You’re also going to encounter a wide range of senior living costs. So when considering what your loved ones will be paying for senior living, how do you find a community that fits their needs as well as their budget?

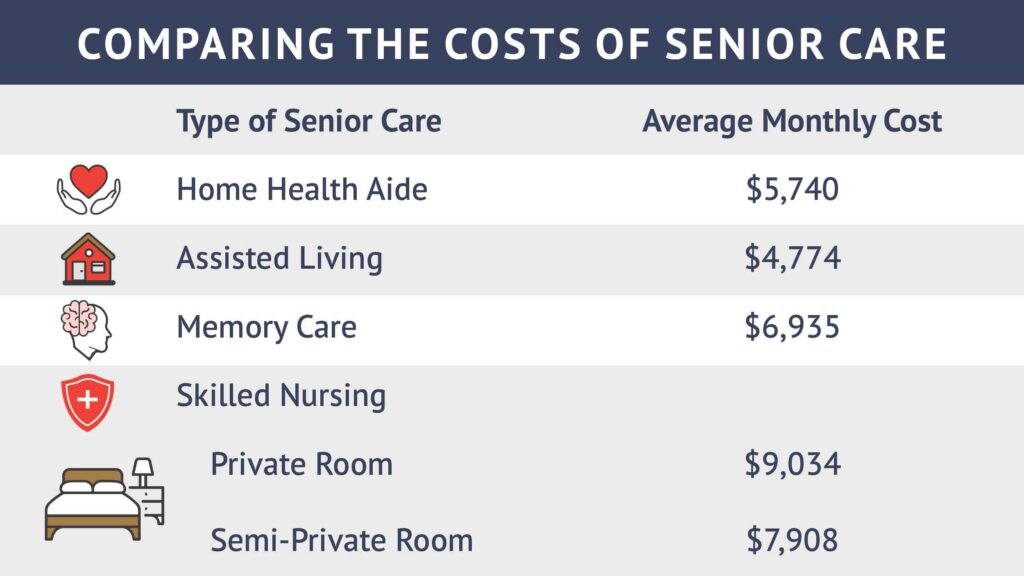

This article focuses on the average monthly costs of senior living for assisted living, memory care, skilled nursing and home health. Pinpointing an exact amount depends on the type of senior care community and the lifestyle that’s best for your loved one. The geographic location and the number of services provided will lower or increase the fees and monthly rates.

Statement of Fairness: Considering senior living options for yourself or a loved one? We’re here to help at every step. And even though we specialize in independent living communities, our goal is for YOU to find your best path to gracious retirement living, and part of how we achieve that is by providing reliable information on all types of senior living, not just the ones we offer. When our offerings serve as useful illustrations to a specific topic, you can find that information in the attached sidebar.

Disclaimer: This content is not intended as financial advice. Remember to review your plans and budgets with a licensed financial professional when making significant financial decisions.

What are the Different Types of Senior Care?

Retirement communities offer maintenance-free living in a safe, secure, age-friendly home. Healthy dining and enriching activities combine to create a social atmosphere that keeps residents physically, emotionally and mentally strong. The monthly costs of senior living increase as the individual’s need for personal care rises.

Independent Living

Independent living communities for adults 55 and older feature apartments, condominiums, townhomes and freestanding housing. Residents are able to live on their own without the need for personal care.

Assisted Living

Residents enjoy the same amenities as those in independent living, but they also receive help with the activities of daily living like dressing, bathing, toileting and mobility.

Memory Care

This type of senior care provides a greater degree of personal assistance in a structured, secure environment for those diagnosed with dementia, Alzheimer’s disease and other cognitive difficulties.

Skilled Nursing

While recovering from an illness, surgery or injury, patients receive hospital-level care from trained registered nurses.

Continuing Care Retirement Communities (CCRC)

Independent senior living, assisted living, memory care and skilled nursing are housed in one building complex. The fee structure is based on contracts that allow access to services and care.

Home Health Care

Home health care brings trained personnel to your door. These visits provide basic medical care for people recovering from an illness, surgery, injury and long-term chronic conditions.

How Much Does Assisted Living Cost?

Across the United States, the average cost of assisted living is $4,774 per month. Missouri has the lowest median cost ($3,183 per month). Alaska and Rhode Island top the chart with $7,246 per month. See how your state compares by using the Genworth Cost of Care Survey calculator.

If you’re looking for ways to pay for assisted living, it will be mostly out-of-pocket, perhaps financed by the sale of a home and savings. Medicare and most health insurance policies don’t contribute to the cost of long-term care, although you may be able to claim the costs as a medical expense on your taxes. Talk to your accountant to be sure. Medicaid coverage varies by state.

How Much Does Memory Care Cost?

A safe, supportive memory care facility for people with Alzheimer’s disease, dementia and other cognitive difficulties is expensive due to the intense level of assistance needed by the residents.

Memory care usually costs 20% to 30% more than assisted living. The National Investment Center for Senior Housing and Care estimates the average monthly cost to be $6,935.

Medicare covers some of the costs of a memory care facility with things like meals, medication, hospital supplies and general nursing care. Medicaid may also cover some or even all of the costs for qualifying individuals for this type of senior care.

How Much Does Skilled Nursing Cost?

Skilled nursing provides round-the-clock medically intensive care and therapies by trained nurses. The length of stay, number of services and the geographic area determine costs for this type of senior care.

The median monthly cost of senior care in a semi-private room is $7,908, while private rooms are $9,034. By state, Alaskans pay the most at $31,512, while Missourians pay the least at $5,262. Costs rise every year, so use the Genworth Cost of Care Survey calculator for the most current rates in your area.

Medicare Part A covers up to 100 days in a skilled nursing facility. After that, a long-term care policy can help if you have purchased one. A nursing facility must be Medicaid-certified in order for your eligible loved one to receive benefits.

How Do Assisted Living, Memory Care and Skilled Nursing Prices Compare to The Cost of Home Health Care?

Many older adults wishing to stay in their homes require health care assistance. Licensed professionals such as nurses, certified nurse assistants, physical therapists and occupational therapists can help with bathing, eating, wound care, therapy and other medical care for short- or long-term disabilities and chronic conditions.

As with assisted living, memory care and skilled nursing, home health care costs vary by state. The national median is estimated at $30 per hour. The cost of living in your area, your state’s minimum wage, and the amount of assistance provided will bring the price up or down from the median.

When health care services are prescribed by a doctor, Medicare will cover eligible costs if the person is homebound and unable to be transported to medical treatment.

If your loved one is still a homeowner or renter, add housing, food and transportation to the monthly cost of senior living.

What Other Monthly Expenses Should be Included in Comparing Senior Living Costs?

To compare costs across key dimensions to aid in decision making for senior care costs, we must use a variety of other fixed and variable monthly costs associated with living alone versus living in a senior living community. These include:

- Food costs

- Transportation costs

- Lifestyle costs

- Maintenance costs

Food Costs

For many seniors, food costs can be an overwhelmingly large part of their monthly budget, whether they cook at home or dine out. When you look at the monthly cost of senior living and the time and effort it takes to create meals at home, you’ll find that one is definitely a better option than the other.

In 2023, the average cost per meal is $4.31 per meal. When choosing to dine out, the average cost of a meal is about $20.37. For seniors living at home, it can be a mental and financial burden to plan, shop and prepare meals and snacks each day. Those no longer able to easily cook for themselves may only be able to afford and prepare convenience foods, which are often not only more expensive, they are usually not as healthy or nutritious as freshly-prepared meals.

In senior living communities, meals are included in the monthly rent, with a dedicated team that assists with ordering, serving and the ability to customize for specific dietary needs and preferences. Meals are sourced from fresh ingredients and with a rotating variety on the menu, allowing for excellent culinary experiences during every meal.

Transportation Cost

When a senior lives on their own, transportation may not be always readily available when a resident needs it. Some seniors may rely on community shuttles, which can be inaccessible or not readily available when needed.

Further, many city shuttles work on a fixed route, leaving seniors without access to return home or to go where they truly need to go.

When residing in a senior living community, transportation is included at a residents’ request, offering free or low-cost accessible transportation services to medical provider appointments, community outings, and more.

While the route is customizable, all destinations are available, the service is also free – saving hundreds per month on cab rides to important appointments.

Lifestyle Costs

Recreational and social activities are included in the monthly fee for senior living communities and many offer robust activity calendars to keep residents engaged through enrichment activities. These activities are provided on-site, so planning ahead is minimal.

With built-in activities, it is easier for residents to create and nurture relationships in the community with neighbors, new friends and the dedicated team members that interact with them every day. These meaningful connections help reduce isolation and improve overall mood and morale, benefiting both physical and mental health in seniors. This alone is one of the priceless benefits of a community when looking at the cost of senior living.

The power of connection is a benefit to the senior living community that cannot be achieved easily while living alone. A study shows that weak social connections are linked to higher rates of later-in-life cognitive decline and increased mortality, so having that extra support system around seniors is not only good for daily life, but long-term health.

In addition to socialization activities, amenities such as walking paths, fitness centers, onsite beauty parlors and common areas are huge perks for seniors living an independent lifestyle. In senior living communities, amenities and services are included in the price of senior living – complimentary housekeeping, linen, and laundry services, plus round-the-clock caregiving support as needed.

Maintenance Costs

Finally, additional variable fees such as home maintenance and keeping up with utilities can become more of a hardship for seniors living alone, and those who assist them. A senior living on their own would pay additional costs per month for cleaning, activities and other personal services, and those individual costs can become very expensive.

How Can I Find a Community That Fits a Retirement Budget?

Don’t just rely on brochures or ads. Visit the types of senior care communities in your area and talk to the management and residents. Researching and comparing the monthly costs of senior living will help you find the best combination of price and lifestyle.

Start the search for retirement homes before your loved one has a condition requiring them to move. Having to decide in the middle a crisis or emergency brings extra stress to everyone.

Is it Possible to Get a Discount or Negotiate Costs?

It definitely pays to ask.

- After an assessment, the community’s advisor will give you a list of assistance services your loved one will need. Each service increases the monthly cost of senior living. Review that list to see if all the suggested help is truly required.

- You can get leverage if you find out the community’s occupancy rate. If there’s not a wait list, you may be able to get an entrance fee (if there is one) or other costs waived. The end of the month is the best time to do this.

- If you’re not comfortable haggling about price, placement agencies can help. They can also help you find the type of senior care your loved one needs.

- Ask about move-in offers and incentives. You’ll probably see those on their website. These discounts bring down the monthly cost of senior living for a limited time.

- Would your loved one be willing to share an apartment with a roommate? Sharing costs lowers the financial burden for you and another family.

Are There Ways to Manage Senior Care Costs Long-Term?

Planning, investing and budgeting are key factors in managing senior care costs.

Long-term care policies are a form of insurance. You will pay premiums and make claims for reimbursement on health care services. Your policy will state how much money you can receive daily or monthly. Many long-term care policies have limits on how much they will pay and for how long. The younger you are when you buy this policy, the lower your premiums will be but the more premiums you’ll have to pay. Be aware that rates can rise every year.

A Health Saving Account (HSA) allows individuals to put away money before taxes to cover health care costs. After the age of 65, these dollars can be withdrawn when needed tax-free. It will help pay for insurance deductibles and copays, prescription drugs, qualified long-term care services and more. Spouses and dependents can use these funds as well.

Withdrawals from 401(k) plans are penalty-free after the age of 59 ½. These amounts are subject to tax unless it’s a Roth IRA. Talk to a financial planner about your investments.

Your loved one may have a Power of Attorney in place that allows a designated person to act on their behalf if they are not able. If there is no power of attorney and you are concerned about your loved one’s ability to manage their assets, you can work with a lawyer to create a court-appointed financial conservatorship.

Looking into senior care costs may come with a bit of sticker shock in the beginning. By being realistic about monthly budget, weighed with the inclusion of benefits of one monthly fee, you may find that one level of care – for instance, starting with home health care, may be the right decision for your loved one now, with the flexibility to move as abilities and needs change.

A move to a retirement community comes with tremendous benefits. Older adults thrive in a safe, supportive environment designed to help them age well. But with all the services and benefits, come financial considerations that require careful planning. The price of senior living can feel overwhelming. By comparing the senior care costs of assisted living, memory care, skilled nursing and home health care, you’ll make an informed financial decision that’s right for your loved one’s needs.

Disclaimer: This content is not intended as financial advice. Remember to review your plans and budgets with a licensed financial professional when making significant financial decisions.

DID YOU ENJOY WHAT YOU JUST READ?

Join our exclusive community and subscribe now for the latest news delivered straight to your inbox. By clicking Subscribe, you confirm that you agree to our terms and conditions.

Looking for a welcoming community at a budget-friendly price?

Kennedy Meadows is your place to enjoy the best that senior independent living has to offer, all for one inclusive monthly rent. See our newsletter for a look at what we’re doing this month.

There’s a secret to living well in retirement.

Discover how to get the most out of your retirement savings at Parker Place. Great dining, friendship and activities make for an independent lifestyle worth having. Take a peek at our photo gallery.

It’s time to go maintenance-free.

At The Savoy, you’ll give up the costs and responsibilities of home ownership and start having well-earned fun. Download our brochure and do a cost comparison.

Frequently Asked Questions:

What are the main types of senior living and how do their costs differ?

Senior living options include independent living, assisted living, memory care, skilled nursing, and home health care. Costs vary significantly depending on the level of care required: independent living is generally the most affordable, while skilled nursing and memory care tend to be the most expensive due to the intensity of services provided. For example, the national average monthly cost for assisted living is $4,774, while memory care averages $6,935 per month and skilled nursing ranges from $7,908 for a semi-private room to $9,034 for a private room. Home health care is typically billed hourly, with a national median of $30 per hour.

What additional monthly expenses should I consider when comparing senior living options?

Beyond the base cost of care, it’s important to factor in other monthly expenses such as food, transportation, lifestyle activities and home maintenance. In senior living communities, many of these costs – meals, transportation, social activities and housekeeping – are often included in the monthly fee. In contrast, seniors living at home may need to budget separately for groceries, dining out, transportation, home repairs and personal services, which can add up quickly.

Are there ways to reduce or negotiate the costs of senior living?

Yes, you use several strategies to help manage or lower senior living costs. After a community assessment, review the list of recommended services to ensure only necessary ones are included. You may be able to negotiate entrance fees or other costs, especially if the community has available units. Ask about move-in incentives or discounts, and consider sharing an apartment to split costs. Placement agencies can also assist with negotiations and finding the right fit for your needs. Long-term financial planning, including long-term care insurance and health savings accounts, can also help manage expenses over time.

FIND YOUR COMMUNITY

Related Articles

STORIES, INSIGHTS & RESOURCES

As you and your loved ones navigate the exciting opportunities retirement presents, thoughtful planning is key. Stay informed with empowering articles for seniors covering health, lifestyle, finance and more.

Chronicles Of The Heart

RESIDENTS SAY INDEPENDENCE IS A TOP PRIORITY

Below, residents explain how much they appreciate the freedom they experience at our independent living community. It’s empowering to continue to make your own decisions, and you’re free to create your day around your personal interests.