Money and Family: Having the Talk

Navigating the intricacies of money and family dynamics can feel like walking a tightrope. For many, approaching the topic with adult children can be daunting, often stirring feelings of awkwardness, discomfort or even embarrassment. Yet these discussions are vital, forming the cornerstone of effective estate planning and fostering stronger family ties.

The Money and Family Dilemma

Feeling overwhelmed or hesitant? You’re not alone. The mix of emotions—awkwardness, discomfort, perhaps even a touch of embarrassment—that comes with discussing finances with your adult children is a common experience.

Don’t worry. You can handle this conversation smoothly by thinking things through and getting ready. Done right, these conversations will help bring your family closer together.

The Big Question: How to Talk About Money and Family?

Families are rarely in full agreement on financial matters, but how you handle this discussion makes a big difference. Set yourself up for success by:

- Acknowledging the nuanced role finances play in life and approaching the conversation with simplicity and honesty can reduce stress and provide peace of mind for everyone involved.

- Acknowledging and addressing any concerns your adult children may have.

- Initiating the conversation with care and sensitivity, setting a positive tone from the start.

Statement of Fairness: Considering senior living options for yourself or a loved one? We’re here to help at every step. And even though we specialize in independent living communities, our goal is for YOU to find your best path to gracious retirement living, and part of how we achieve that is by providing reliable information on all types of senior living, not just the ones we offer. When our offerings serve as useful illustrations to a specific topic, you can find that information in the attached sidebar.

Disclaimer: This content is not intended as financial advice. Remember to review your plans and budgets with a licensed financial professional when making significant financial decisions.

1. Understanding the Complex Landscape of Money and Family

So, what does money mean to you?

If you think it’s all about numbers, that’s only half the story. Money and the status it brings define how we feel about ourselves and others.

We each have our own take on this hot-button issue, just like politics or lifestyle. Our wealth can represent achievement, security and contentment. On the flip side, we can feel guilt, shame and fear. Most often it’s a combination of these positive and negative aspects.

This volatile mix can cause tension within family dynamics, but the benefits of an open, honest conversation and asking important financial questions far outweigh the potential pitfalls.

By choosing to talk about finances early, you ensure that your decisions reflect your values, giving you confidence that your wishes will be respected. And by knowing the facts, your family will feel empowered to make informed decisions if a crisis occurs.

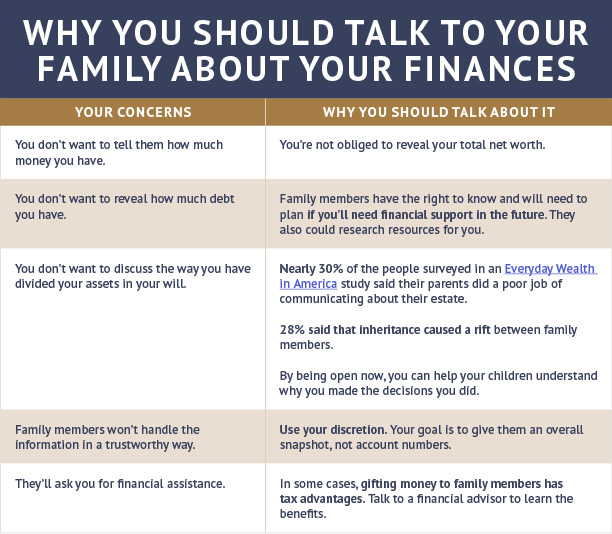

2. Getting Through the Fears About Money and Family

Why have you put off the talk about money with your adult children?

You probably didn’t hear your parents discuss the subject unless it was during an argument. As we grew into adulthood, we repeated that cycle with our own family. Finances were private and taboo.

Open Communication Goes Both Ways

Does this put you on the spot to give a lecture or presentation?

Nothing could be further from the truth. If your family feels free to ask questions or speak up about concerns, you’ve given them the gift of having a safe place to work through tough issues.

When you talk to your family and finances are the topic, open communication creates the opportunity to:

- Provide peace of mind by eliminating uncertainty and financial surprises

- Share your life experiences

- Communicate your values

- Guide their future financial decisions.

- Foster trust.

- Strengthen bonds.

- Resolve issues before they become problems.

3. You’re Ready to Start the Conversation … Almost

- Assess your financial situation. Make a list of your accounts along with the companies or institutions. No need to include account numbers or balances unless you’re speaking with your executor or power of attorney.

- If you have a statement from an investment firm or financial institution that includes charts and graphs, use these as visual aids. A pie chart is a great way to show your budget.

- Organizing your information in advance like this can make the discussion easier and more straightforward for everyone, helping you focus on what matters most.

- Set clear goals for the discussion. Think of this as another step in your proactive approach to planning, ensuring clarity and confidence for yourself and your family. In order to stay focused and make good use of everyone’s time, limit the subjects. Decide if the conversation will be about estate planning, budgeting, paying down debts or financial goals.

- Get ready for Q&A. Expect to hear the concerns that have been on your children’s minds.

- Have you been paying your bills on time?

- Are you able to balance your checkbook?

- What will happen if you can no longer take care of your accounts?

- Who is your executor?

- Where do you keep your financial papers?

- Who has access to your accounts?

- Who has the keys to your lockbox?

- Do you have a long-term care insurance policy? Can I read it?

- Do you have enough money if you need assisted living?

- What should we do if …?

- If you’ve prepared, you’ll have answers, but being faced with so many financial questions at once can stir up emotions for everyone involved. You might feel attacked or defensive. Don’t try to tackle everything at once. Schedule a follow-up meeting to give you and your children and yourself time to cool down and think.

- Arm yourself with the tools for effective communication. Try the 7 C’s. Be:

- Clear. If you think your family isn’t understanding, restate your point or ask another person to repeat the information back to you.

- Concise. Stick to your subject and don’t overwhelm everyone with too many details.

- Concrete. Here’s where your graphs, charts or other visual aids bring your situation to life.

- Correct. If you’re not sure about something, put it off until a later time.

- Coherent. Even though family and money are emotional topics, stay as logical as you can.

- Complete. If need be, set action items to tee up your next meeting.

- Courteous. This can be a challenging topic, so err on the side of kindness and courtesy.

When it Comes to Talking About Money, Take it One Step at a Time

- Make sure everyone knows the subject and purpose of the discussion beforehand.

- Acknowledge the difficulty of talking about financial matters. “This isn’t an easy topic to talk about, but I know we can get through it as a family.”

- Share why you want to have this discussion. “I’ve seen other families struggle, and I don’t want you to have to go through that.” “I experienced a hard time dealing with my parents’ situation, so I want to get you all up to speed about my finances.” “I know you want to honor my wishes, so let’s start with the basics of my accounts.”

- Instead of a one-sided dialogue, encourage two-way discussion by asking questions and seeking input.

Keeping the Peace

Tempers may flare even though you’ve done your best. Manage your emotions to help others stay calm

- Breathe Slowly and Regularly. This solution is so simple we often forget how helpful it is, especially in times of conflict.

- Pause and Listen. Stop thinking about how to answer. Instead, hear out what the other person has to say. Take the time you need before you speak.

- Restate What You Believe You’ve Heard Without Judgment. Making a person feel understood and listened to goes a long way toward making the speaker feel valued.

- Invite Everyone to Take a Food Break. Hunger and low blood sugar contribute to emotional outbursts and a change of scenery may break a negative mood.

Need More Help? Call in the Pros

If you’ve been working with a financial planner, you’ve got a trusted partner to help you explain your financial situation in a way that everyone can understand. Invite your family to attend a portfolio review or set up a specific meeting to go over your financial picture. Let your advisor know in advance what information you’d like covered. Introducing your financial planner to your children lets them develop a relationship before working out the details of your estate becomes necessary. For families navigating transitions like downsizing or moving to senior living, professionals can provide clarity and ease tensions, ensuring everyone feels confident about this exciting new lifestyle change.

A family mediator can be the lifesaver that protects and preserves fragile relationships. They’re well acquainted with matters related to family finances. Their goal is to help everyone come to a decision through healthy communication and encourage solutions that benefit all concerned.

Because a mediator is a neutral third party, people feel less suspicious or defensive speaking to them. Leave it to the mediator to ask the hard questions and get the conversation going if things stall.

The Academy of Professional Family Mediators offers an online locator to help you find one in your area.

Money and Family: A Cycle of Growth and Understanding

Whether or not you employ the help of professionals, the more often you talk about money, the easier it becomes. Regular conversations help foster trust, enabling your family to work together toward shared goals while ensuring your independence and reducing stress. Just as finances shift over time, this discussion needs to keep going. Before each meeting, remind yourself:

- Money is a complex issue that brings up strong emotions.

- Your adult children’s concerns come from the heart.

- Open communication is the best way to navigate through hard topics while keeping your family bonds strong.

When it comes to estate planning, your finances play a crucial role that affects your future and your family’s. While you may never feel 100 percent comfortable sharing the details, talking with your adult children is the best path forward for you all.

DID YOU ENJOY WHAT YOU JUST READ?

Join our exclusive community and subscribe now for the latest news delivered straight to your inbox. By clicking Subscribe, you confirm that you agree to our terms and conditions.

El Dorado Estates: El Dorado Hills Senior Living Made Easy

El Dorado Estates combines comfortable amenities with convenient services that add up to the perfect retirement lifestyle. Your monthly rent includes three chef-prepared meals daily, local transportation, a weekly housekeeping service, and a calendar filled with planned activities and special events.

Come meet our live-in management team, friendly staff and fun-loving community.

Carolina Estates Simplifies Your Monthly Expenses

Imagine a life free of utility bills and maintenance worries. That’s what you can expect at Carolina Estates in Greensboro.

Your all-inclusive rent covers electricity, gas, water, sewer and even basic cable, simplifying monthly expenses and providing peace of mind. It’s budget-friendly convenience you can count on.

Frequently Asked Questions:

Why is it important to talk openly with adult children about finances and estate planning?

Open conversations about money help reduce stress, prevent financial surprises and ensure that your wishes are respected. These discussions also foster trust, strengthen family bonds and empower everyone to make informed decisions in case of a crisis.

How can I prepare for a productive financial conversation with my family?

To prepare for this conversation, start by organizing your financial information, setting clear goals for the discussion, and being ready to answer common questions about your accounts, bills, and future plans. Using visual aids like charts can make things clearer, and focusing the conversation on specific topics helps keep it manageable.

What should I do if financial discussions with my family become emotional or difficult?

Acknowledge that talking about money can be uncomfortable and emotional. Use strategies like pausing to listen, restating what you’ve heard and taking breaks if needed. If necessary, consider involving a financial planner or family mediator to help guide the conversation and maintain positive relationships.

FIND YOUR COMMUNITY

Related Articles

STORIES, INSIGHTS & RESOURCES

As you and your loved ones navigate the exciting opportunities retirement presents, thoughtful planning is key. Stay informed with empowering articles for seniors covering health, lifestyle, finance and more.

How to Select a Power of Attorney, and How to Talk to Your Family About Your Choice

Conversations on Heirlooms

Downsizing: Dividing Up Heirlooms & Keeping Down Conflicts Have you ever looked around your home and realized there’s a lifetime of stories tucked into every…

Healthy Boundaries for Seniors: Maintaining Independence with Adult Children

Chronicles Of The Heart

RESIDENTS SAY INDEPENDENCE IS A TOP PRIORITY

Below, residents explain how much they appreciate the freedom they experience at our independent living community. It’s empowering to continue to make your own decisions, and you’re free to create your day around your personal interests.