If there’s one thing more certain than taxes, it’s elder fraud. According to the FBI, over $3 billion disappears annually from the accounts of older Americans, proving that not all disappearing acts happen on the magician’s stage. Scammers have turned targeting seniors into an art form, a not-so-funny comedy where the punchline is your compromised personal information.

Adults over 60 years old are the primary target of elder fraud, whether it’s done online, by phone or face-to-face. Some criminals are out to steal personal information like Social Security, credit card and bank account numbers. Some take advantage of your willingness to do good by posing as legitimate charities. Others promise products and services that never materialize.

By learning about online safety, protecting personal information and staying cautious about finances, you can keep yourself or someone you love from being the next elder fraud victim.

Statement of Fairness: Considering senior living options for yourself or a loved one? We’re here to help at every step. And even though we specialize in independent living communities, our goal is for YOU to find your best path to gracious retirement living, and part of how we achieve that is by providing reliable information on all types of senior living, not just the ones we offer. When our offerings serve as useful illustrations to a specific topic, you can find that information in the attached sidebar.

Disclaimer: This content is not intended as financial advice. Remember to review your plans and budgets with a licensed financial professional when making significant financial decisions.

It’s Important to Stay on Your Toes

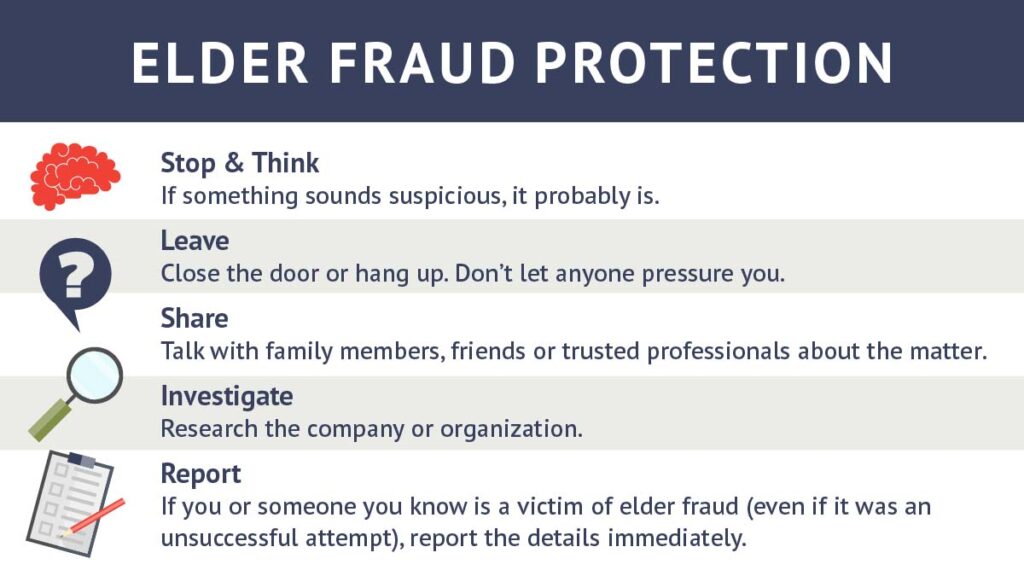

Because older adults are often more polite and trusting, keeping ahead of elder fraud swindlers can be challenging. Use your common sense, and if it sounds too good to be true, it probably is.

Be Alert

It used to be easier to spot a scam. Words were misspelled, and sentences didn’t sound quite right. Now the bad guys are getting craftier, and you may not be able to tell if the call, email, text or social media invite is real or not. Take your time and investigate.

If you’re worried about your loved one, check in regularly to see who they have been talking to. Open communication can uncover information vital to elder fraud protection.

Be Proactive

Before working with a new company or organization, do your homework. The company’s online reviews may not be telling the real story. Check with the Better Business Bureau to see if they’re reputable. When someone asks you for a donation from an organization you’ve never heard of, look them up on the Charity Navigator website.

5 Elder Fraud Protection Tips

- Look out for the most common scams. And just say NO! Remember, when your caller ID says “Unknown,” it’s just a polite way of saying, “Don’t pick up, I’m trouble!”

- Lottery scams. You may find out by phone or by email that it’s your lucky day! You’ve won a large amount of money in a contest. You probably don’t remember entering – because you didn’t. The scammer will ask you to pay a fee in advance to receive your reward.

- Tech support scams. Out of the blue, you get a phone call, online pop-up or email from Microsoft telling you there’s a problem. To fix it, they need remote access to your computer. Beware: If you let them in, they’ll steal all your information.

- IRS scams. The voice mail or email sounds angry and threatening. You’re told you owe back taxes and if you don’t pay them, you’re headed to jail. Or maybe they tell you you’re due a refund, in that case, they need your bank account information so they can forward the money to you. That’s not how the real IRS communicates.

- Phone scams. Your phone rings, but you don’t recognize the number. When you answer, the fake telemarketer (maybe even a recording) will try to sell you something. Just like the lottery and IRS scam, they’ll ask you for personal information and your bank account number.

- The Grandparent Scam. Your “grandchild” texts you to say they’re in trouble. Hearing that would panic the best of us. These con artists posing as your grandchild will ask you for bail money to be sent via a courier or electronic transfer. As a defense, many families choose a safe word that can identify the real relative from the imposter.

- Practice online safety.

- Install the latest anti-virus and firewall security software to detect and block malicious content before it reaches your screen.

- Create strong passwords for all your accounts and never share them. Passwords and PINs are notoriously hard to remember, but writing them down on a sheet of paper is a bad idea. A password manager can help. This technology tool creates, saves and uses passwords more effectively.

- Turn on 2-step verification for your online accounts. After putting in your username and password, you will receive a code via text, voice or email to enter to prove it’s really you.

- Check before you click. Whether a friend or stranger sent the email, avoid clicking suspicious links without checking where they lead. It doesn’t matter if it’s a long URL or a shortened one – if it’s dangerous, a link checker can tell you. These tools help by identifying compromised websites, so you can avoid potential scams and malware. Here are a few reputable sites that let you check if links are safe or not.

- Keep your personal information personal.

- Don’t let your mailbox fill up day after day. Letters and statements are easily stolen.

- Shred bills and statements before throwing them away.

- Sign up for the National Do Not Call Registry. It’s a free service provided by the Federal Trade Commission (FTC). To put your number on the list, call 888-382-1222 or register online. Not only will this cut down on telemarketer calls, it’s also an important elder fraud protection safeguard.

- It’s smart to say no when asked for personal information. Sharing personal data, like a Social Security number, with an unfamiliar contact is like lending car keys to a stranger. We wouldn’t trust a stranger with our car, so why would we trust them with our livelihood?

- Keep a sharp eye on your finances.

- Carefully check your financial, insurance and Social Security statements to detect any changes.

- If you haven’t already done so, choose someone you trust to be your financial power of attorney. Your financial power of attorney can pay your bills and monitor accounts if you are unable to handle these responsibilities. You don’t need a lawyer to appoint someone. Eldercare, a public service of the U.S. Administration on Aging, can help free of charge.

- Authorize your financial institutions to contact someone you trust if they’re not able to contact you.

- If you start receiving bills for items you did not buy or debt collection calls from accounts you did not open, you are a victim of identity theft.

- If you suspect anything, contact your bank.

- Be wary of unsolicited contact.

- Don’t answer phone calls, texts, social media messages or emails from people you don’t know.

- You may think that responding to a security alert from the Internal Revenue Service, Medicare or the Social Security Administration is a way to act fast and protect yourself. Wrong. No matter how official those unsolicited calls, emails or texts sound, government agencies will never contact you to request or verify your personal information.

What Should I Do if I (Or My Loved One) Are Victim of a Data Breach?

Cybercriminals target companies both big and small. In case of a large data breach, the company must alert you about what personal information has been exposed and stolen.

Take these steps if you’re part of a large data breach or if you’re a victim of elder fraud:

- Change the passwords and PINs to your bank and credit card accounts.

- Place a fraud alert on your Experian, Transunion and Equifax credit reports. The alert will stay in effect for one year but can be renewed. Lenders processing a credit application in your name will then be able to tell that you are a victim of elder fraud or identity theft.

- Watch for any unusual activity on your financial statements and credit reports.

- Report individual instances of elder fraud to government authorities.

How Do I Report Elder Fraud?

Many elder fraud victims are too embarrassed to make a report. But sharing that information can help others and increase the chances of the criminals getting caught. If someone takes advantage of you, a friend or a family member, contact a government agency that will pursue these criminals. Your voice, combined with others, can dismantle these deceptive schemes and safeguard the financial well-being of countless individuals.

Report the incident to the FBI at ic3.gov. You can also call the Department of Justice (DOJ) Elder Fraud Hotline at 833-FRAUD-11 (833-372-8311).

“When criminals steal the hard-earned life savings of older Americans, we will respond with all the tools at our disposal,” says FBI Springfield Field Office Special Agent in Charge David Nanz.

If you contact the Federal Trade Commission (FTC), they will share your report with more than 2,800 law enforcers. Call 877-FTC-HELP (877-382-4357) or TTY 866-653-4261. You can also contact them online at ftc.gov/complaint.

Unless you’re in imminent danger, you don’t have to call 911. Find the dispatch number of your local police department and give them your report.

Tap Into Reliable Resources for More Advice.

The National Council on Aging website is filled with elder fraud protection advice. You’ll learn how to spot the latest scams that put you at risk. Their post Avoiding Scams and Fraud for Older Adults has in-depth, up-to-date information for older adults, caregivers and other professionals. And from helping you steer clear of health insurance fraud and Medicare scams to telemarketing and business swindles, read 22 Tips for Seniors to Avoid Scams.

Elder fraud is ever-changing, with new scams popping up all the time. Scammers are experts at pressuring you into giving out your personal information or agreeing to things that don’t seem right.

If you do find yourself the victim of elder fraud tactics, take the necessary steps to secure your accounts. If you need assistance getting this done, ask a trusted family member, friend or professional. Then help yourself and others by reporting the crime to government-sponsored agencies.

You’re not alone. Adults of all ages are targeted (and often fooled) by scammers. Take your time to research, weigh your options and make logical decisions. By staying alert and proactive, you’ll be ready to stop those fraudsters in their tracks.

DID YOU ENJOY WHAT YOU JUST READ?

Join our exclusive community and subscribe now for the latest news delivered straight to your inbox. By clicking Subscribe, you confirm that you agree to our terms and conditions.

Safeguarding Your Future.

At Linwood Estates, we streamline all monthly utilities into one fee, reducing the risk of fraudulent activities. By consolidating bills, we not only provide convenience but also enhance security, ensuring our residents can enjoy a worry-free living experience. Discover peace of mind at our community.

Choosing an independent senior community is a big decision.

It’s not just about where you want to live – it’s about how you want to live. We invite you to visit us at Hudson Estates, the finest senior living in Lansdale, Pennsylvania. You’ll get to know (and love!) our residents and senior living experts. Our dedicated team members are more than just professionals – they’re compassionate allies. Ready to assist residents through any challenge, our team provides unwavering support, turning obstacles into opportunities for growth and connection. Experience the difference of having a caring team by your side, making every day extraordinary.

UP NEXT

9 min read

Comparing Aging in Place: The Truth Behind the Trend

Right now, you may think that your current home is where your heart is. But before you make that decision, let’s consider what staying in your home would mean for you. In this article, we’ll explore the realities of aging in place, empowering you with insights to make an informed decision that resonates with your unique journey.

Frequently Asked Questions:

What are some common scams that target older adults?

Older adults are frequently targeted by scams featuring lottery “wins” (claiming you’ve won a prize but requiring payment to collect), tech support (calls or pop-ups claiming your computer needs urgent repair), threats from the “IRS” (threatening calls about taxes or refunds), fake telemarketers seeking personal information, and the “grandparent scam” (fraudsters pretending to be a grandchild in distress).

How can I protect myself or a loved one from elder fraud?

Practice online safety by using strong, unique passwords and enabling two-step verification. Be cautious with personal information: Shred sensitive documents, don’t let mail pile up and don’t share details like your Social Security number with unknown contacts. Regularly review financial statements for unusual activity, and sign up for the National Do Not Call Registry to reduce unsolicited calls.

What should I do if I suspect elder fraud or become a victim?

If you suspect fraud, immediately change your account passwords and place a fraud alert on your credit reports. Monitor your financial statements closely for suspicious activity. Report incidents to authorities such as the FBI (ic3.gov), the Department of Justice Elder Fraud Hotline (833-372-8311), or the Federal Trade Commission (877-382-4357 or ftc.gov/complaint).

FIND YOUR COMMUNITY

Related Articles

STORIES, INSIGHTS & RESOURCES

As you and your loved ones navigate the exciting opportunities retirement presents, thoughtful planning is key. Stay informed with empowering articles for seniors covering health, lifestyle, finance and more.

Chronicles Of The Heart

RESIDENTS SAY INDEPENDENCE IS A TOP PRIORITY

Below, residents explain how much they appreciate the freedom they experience at our independent living community. It’s empowering to continue to make your own decisions, and you’re free to create your day around your personal interests.